Does RCEP Herald A Golden Age For APAC SMEs?

By Audrey Cheong | June 1, 2022

The RCEP trade agreement is simplifying import and export for SMEs across Asia – and creating more growth opportunities for cross-border commerce globally.

People have been conducting cross-border and trans-continental trade for millennia. From the ancient Egyptians to the Greeks advancing east into Asia, to the establishment of the Silk Road and the founding of the Americas: across vast land and sea routes, merchants exchanged food, commodities and exotic goods that enriched lives and shaped civilization.

Fast forward to today, and despite – or perhaps because of - disruptions caused by COVID-19, policymakers and business communities have gained a renewed appreciation of the role cross-border trade plays in helping people with their daily needs and keeping businesses running.

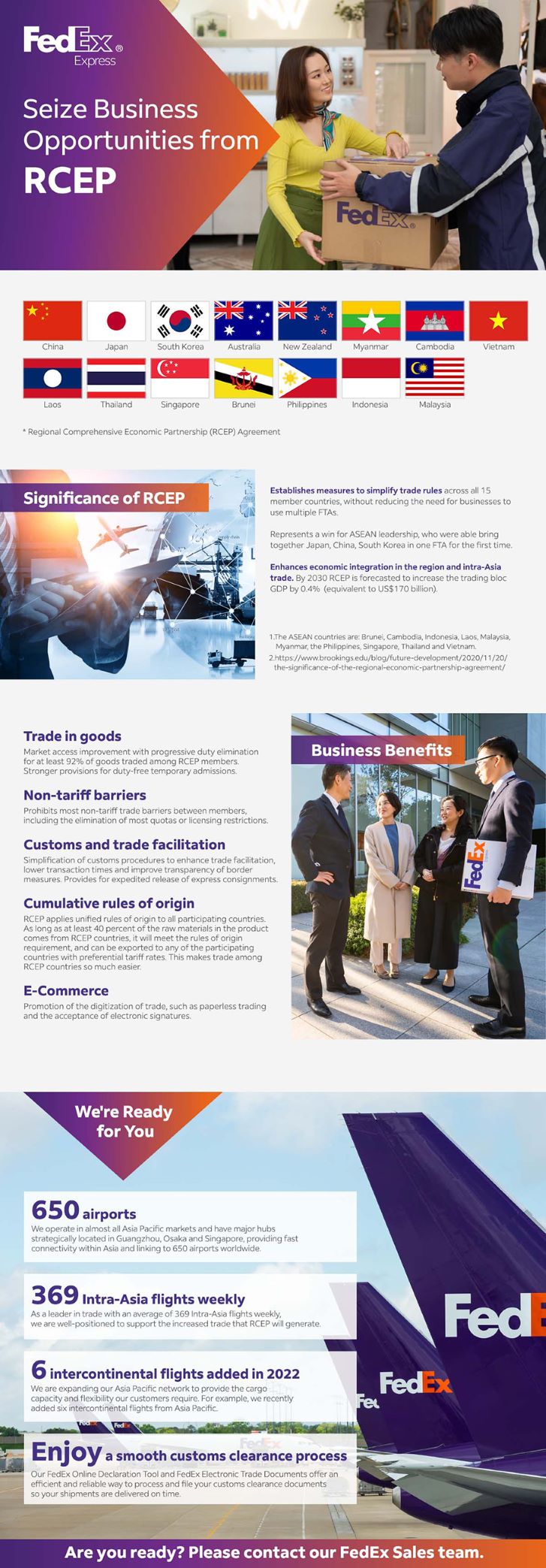

The Regional Comprehensive Economic Partnership (RCEP), the world’s largest trade deal, was born in this challenging time.

Making ‘Factory Asia’ a reality

Effective 1 January 2022, RCEP was signed by 10 ASEAN member states and five of its dialogue partners – Australia, China, Japan, New Zealand and South Korea. It covers nearly a third of the global gross domestic product (GDP) and 30% of the global population. This free trade agreement (FTA) promises to make Asia Pacific a dynamic region for cross-border opportunities.

Similar to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which focuses on combining production bases from countries in the Americas and Asia, RCEP is designed to facilitate stronger trade and commercial ties between participating APAC countries. Cutting tariffs, eliminating barriers to trade and investment, and consolidating production bases all contribute to maximum efficiency. All this could turn the ‘Factory Asia’ aspiration into reality.

While some critics say that RCEP will only benefit large economies like China, Japan, and South Korea, ASEAN economies certainly have the opportunity to gain a significant economic boost - especially when you consider the close-knit ties that already exist between the two sub-regions.

In fact, the RCEP is projected to boost ASEAN’s GDP by as much as US$160 billion in 2035 and increase the value of exports and imports by more than US$500 billion.

Powering up SMEs with harmonized rule of origin

Tariffs on more than 65% of traded goods are now reduced to zero under the agreement and further reductions are planned to almost 90% of goods over the next 20 years. Finance-lean small and medium enterprises (SMEs) have much to gain in cost-savings which will accelerate trade with neighbouring countries and beyond.

Rules of origin (RoO) are criteria that determine where a product is made. They mean that SMEs and exporters are often burdened with hefty duties and restrictions if importing countries have anti-dumping measures and countervailing duties in place.

With RCEP, companies that source materials from or export to other countries within the trade bloc will benefit from a liberal Rules of Origin (RoO). This will reduce tariff and non-tariff barriers and give preferential market access. It is estimated that the RoO could reduce export costs, boosting merchandise exports among ASEAN member states by around US$90 billion on average annually.

As SMEs in the ASEAN member states begin to move up the global value chain, the RoO can help them expand free-trade options to countries currently too expensive to trade with due to high tariffs. According to Boston Consulting Group, if companies in ASEAN can take full advantage of the RCEP, the region can generate up to US$600 billion a year in additional manufacturing output. It can also increase annual foreign direct investment in manufacturing by up to US$22 billion by 2030.

Simply put, not only can RCEP foster a stronger trade integration for ASEAN SMEs, but it can also make the region more attractive to diversification of supply chains for multinational corporations, or multi-shoring.

Doubling down on ‘China Plus’ strategies under RCEP

Recent COVID-related supply chain disruptions and ongoing trade tensions between the US and China have made businesses realize the importance of diversifying their sourcing across different countries. Multi-sourcing and near-sourcing has become a business imperative. RCEP provides an ideal environment for ASEAN economies and their SMEs to take advantage of the multi-sourcing strategy and compete more strongly on the global stage.

Already, companies adopting a ‘China Plus’ strategy have helped Vietnam become the region’s largest manufacturing hub – thanks to multilateral free trade agreements and competitive labor costs. In Big Tech, Apple is also aggressively diversifying supply chains by setting up factories in places like Indonesia.

Take the production of a garment for an international fashion brand as an example. Traditionally, the entire production could be done in one country, such as Vietnam. Now SMEs in ASEAN member states can join the regional manufacturing supply chain by processing raw materials from, say Thailand, while making semi-finished products in Cambodia. These could then be shipped to Vietnam to become the finished goods and then shipped out from Vietnam to the overseas buyer.

All that accumulated production is regarded as originating from Vietnam under the RoO framework – a great way to enhance SMEs’ participation in the global and regional value chains while saving trade-related costs.

Accelerating growth with future-ready supply chains

Trade along the early Silk Road wouldn’t have been possible without horses and camels. Although much has changed since, having a reliable carrier to move goods across borders remains critical in global trade.

For aspiring SMEs seeking to expand their footprint internationally, it’s vital to find reliable and future-ready logistics providers to navigate complex business environments, anticipate potential risks and accelerate growth against all odds. Now, with e-commerce and digital trade as a focus under the RCEP, governments and logistics companies are looking to help advance the digitization of the supply chain and improve connectivity in cross-border commerce.

Singapore, a leading ASEAN economy, has already announced the launch of a US$13.1 million Supply Chain 4.0 Initiative to integrate more technology to assist SMEs with any future supply chain disruptions.

As an advocate of global trade, FedEx has long been actively expanding its global networks, improving e-commerce offerings and digitizing its services from last-mile delivery to warehouse management to foster SMEs’ participation in global trade. FTAs like the RCEP, together with support from governments to facilitate the development of smart logistics, is creating a truly robust ecosystem for SMEs to thrive in the years to come.

To learn more about how FedEx can help SMEs accelerate cross-border trade, head here.

***

A version of this article first appeared in SME Magazine on 27 May, 2022.

SHARE THIS STORY

- Generative AI: A New Frontier

- How To Ship A Giant Panda

- How To Make Freight Shipments Work For Your Small Business

- The Rise Of Intra-Asia Trade: Opportunities In The China-Southeast Asia Corridor

- Where Do Old Planes Go When They Retire?

- What’s So Dangerous About Coconuts? Your Guide To Dangerous Goods Logistics

Sign up now and save on your shipping rates!

Sign up now and earn discounts by shipping instantly with FedEx Ship ManagerTM at fedex.com.

Recommended For You

Why Free Trade Agreements Will Boost SME Growth In Asia

Intra-Asia trade and regional connectivity are helping small businesses in the region win customers and free trade agreements are smoothing the way.

Read More

Southeast Asia: The Next Manufacturing Powerhouse?

Vietnam is part of a growing number of production and supply hubs in Southeast Asia. We explore what makes Vietnam successful.

Read More

Philippines SMEs Can Finally Take Advantage Of RCEP

Businesses in the Philippines can now benefit from RCEP. Here, we explore the advantages for regional SMEs and e-commerce operators.

Read More