Find out more about how FedEx e-invoice looks like and start receiving your invoices via email

Dear FedEx customer,

The Dirección General de Impuestos Internos (DGII), is requiring the implementation of electronic invoicing, which is the legally valid document that supports commercial transactions between seller and buyer. At FedEx, we are working to comply with this requirement. For this reason, as of May 10, 2024, we will implement electronic invoicing for all our customers.

FedEx will exchange invoices electronically in XML format with the DGII through a Certified Provider. Through this process, FedEx will obtain prior approval and the DGII will deliver fiscal elements that must be included in the graphic representation of the invoice.

The changes associated with this implementation are:

- Generation of invoice in XML format, including certificate and digital signature confirming its validity. The electronic invoice is a replacement of the fiscal printer invoice.

- New graphic representation format (PDF) of the electronic invoice.

- For those customers enrolled in FedEx Billing Online (FBO), the electronic invoice will be sent by email in XML and PDF format.

- The invoice in PDF format with valid fiscal approval elements will be available on FBO, eliminating the delivery time for invoices generated on a fiscal printer.

If you have additional questions, please contact your FedEx Sales Executive.

Sincerely,

FedEx, Dominican Republic

Latin America and Caribbean Division

An Electronic Invoice is a legally valid digital document, which supports the commercial operations between seller and buyer, containing the data of the transaction performed, which is electronically signed by the issuing merchant and electronically authorized by the Qualified Authorization Provider (PAC).

The electronic document differs from paper because it is created through a digital system that uses XML files to generate, convey and transfer the information. An Electronic Tax Invoice has at least three basic elements:

- Data message based on the universal, open, non-proprietary standard: XML, extensible markup language

- Use of electronic signature

- Validated and approved by the government through Qualified Authorized Providers (PACs)

The Electronic Tax Receipt (e-CF) has the same validity and legal effects as the non-electronic tax receipt, however, they differ from these in that they are issued electronically, maintain a standard format (XML) and are electronically signed, which offers greater security and integrity to the document.

The Electronic Tax Receipt differs from the non-electronic Tax Receipt in that:

- It is issued electronically

- It has a standard invoice format (XML).

- It is digitally signed by means of a Digital Certificate

- It has greater security and integrity of the information

- It does not require printing on paper if the receiver and issuer are electronic.

No, the types of Electronic Tax Receipts are different, as established in General Rule 05-2019 on types of Special Tax Receipts and General Rule 01-2020 that Regulates the Issuance and Use of Electronic Tax Receipts (E-CF) in the Electronic Invoicing Process.

- Electronic Tax Credit Invoice

- Electronic Consumption Invoice

- Electronic Credit Note

- Electronic Debit Note

- Electronic Special Regimes

- Government Electronic

- Electronic Tax Credit Invoice: Those electronic tax vouchers that record the commercial transactions of purchase and sale of goods and/or services, and allow the recipient or user who requests it, to support expenses and costs or tax credit for tax purposes.

- Electronic Consumption Invoice: Those electronic tax receipts that accredit the transfer of goods, the delivery in use or the rendering of services to final consumers.

If the customer is not electronic, the issuer of the e-CF will deliver a printed representation (RI) of the Electronic Tax Receipt and the recipient must report his purchases in the usual way in the Costs and Expenses Submission Form (Form 606).

Using the current consultation channels of the web portal, such as NCF/e-NCF consultation and the mobile application, the following additional services were created:

- Receiver query web service.

- QR code query on any Printed Representation (RI) of an e-CF.

A digital certificate or electronic certificate is a computer file electronically signed by a certification service provider, considered by other entities as an authority for this type of content, which links signature verification data to a signatory, so that only this signatory can sign, and confirms his identity. It has a data structure containing information about the entity (e.g., a public key, an identity, or a set of privileges). The signature of the data structure groups the information it contains in such a way that it cannot be modified without this modification being detected.

The Dirección General de Impuestos Internos (“DGII”) has a web service with the URLs (Authentication, Receipt and Commercial Approval) of electronic taxpayers, as well as an option to view and download the same through the Virtual Office within the electronic invoicing menu. If the taxpayer has deposited its URL(s) in the DGII portal directory, the taxpayer will be able to access to obtain and consult the tax documents.

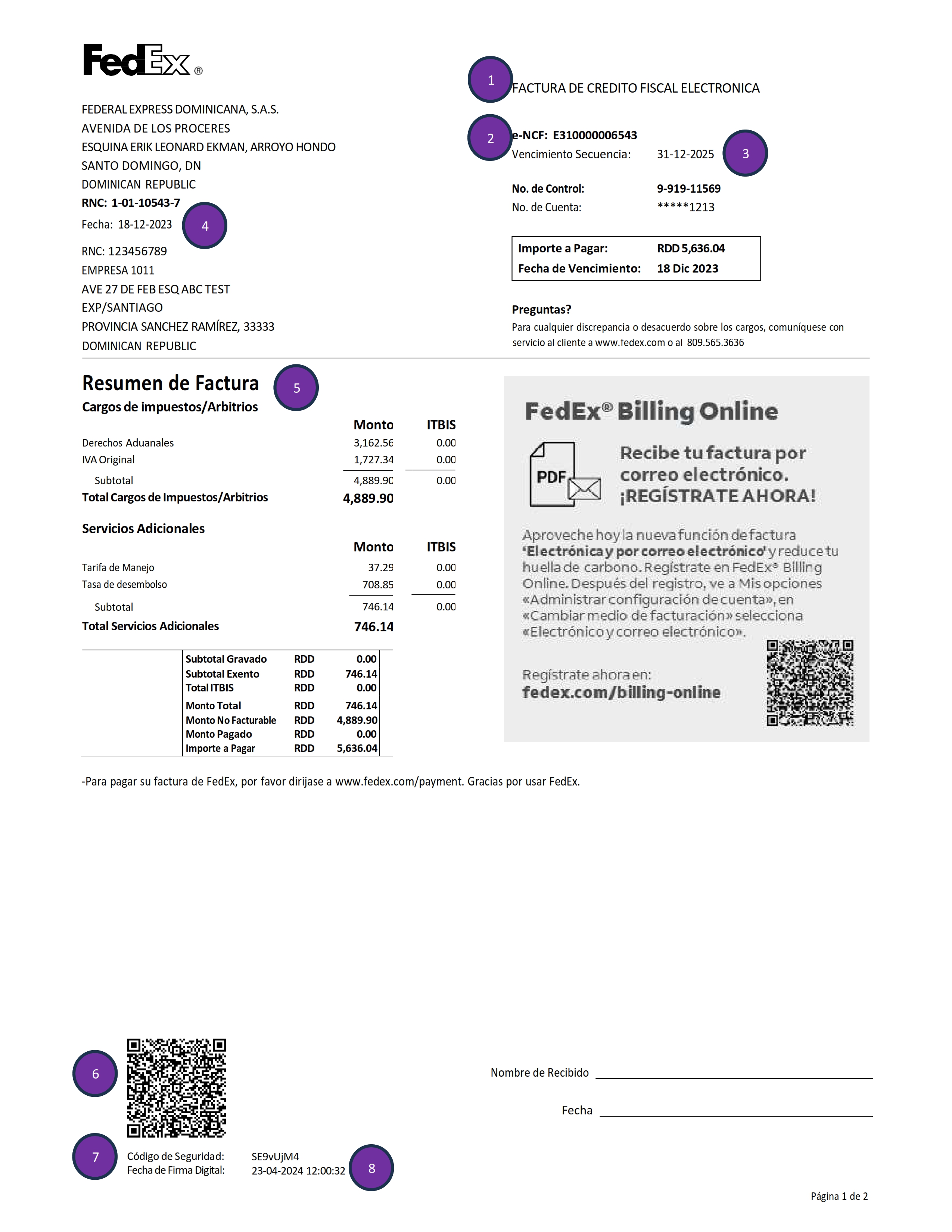

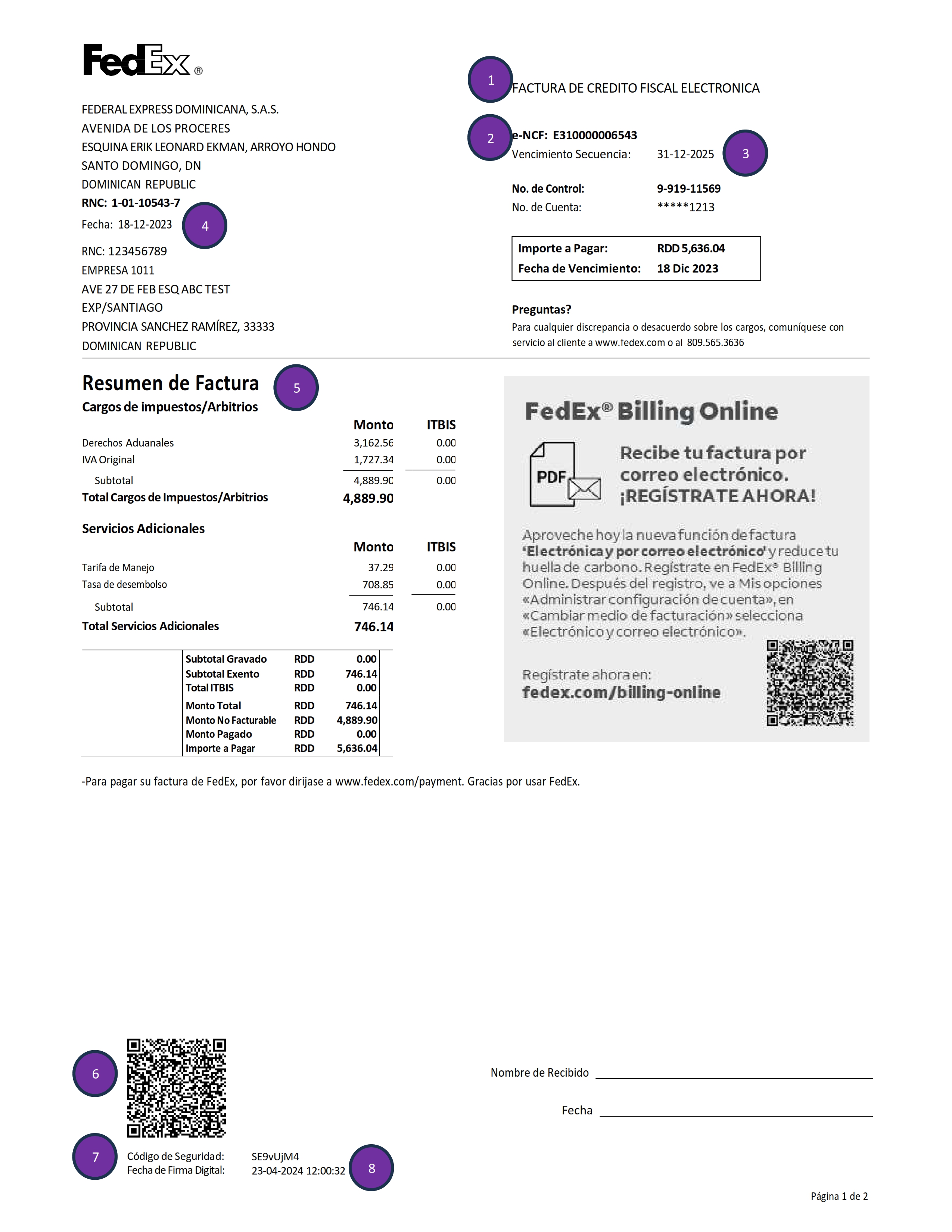

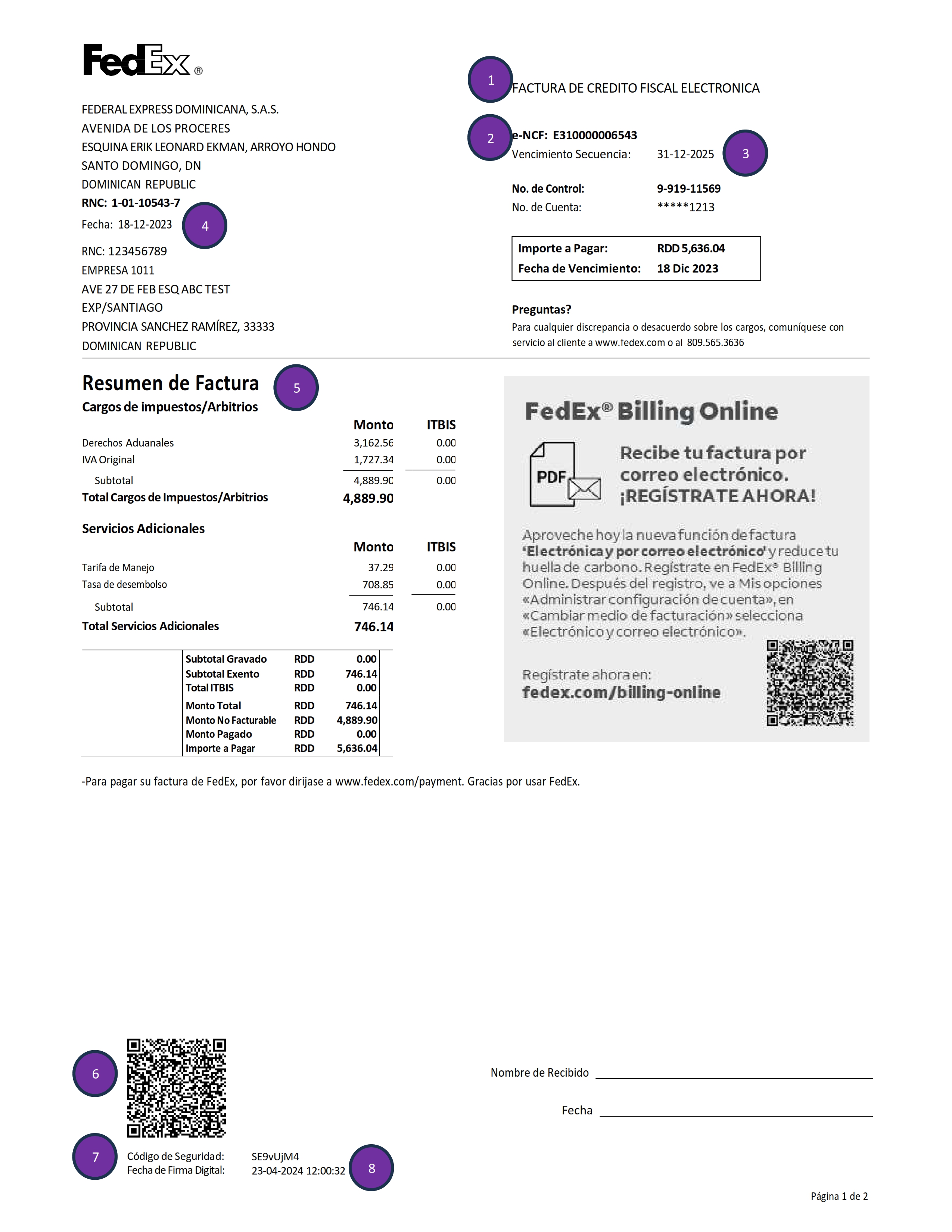

- The title of the invoice will correspond to the type of electronic tax voucher being issued, e.g. Electronic Tax Credit Invoice, Electronic Consumption Invoice, etc. Currently the title of the invoices is headed “Tax Invoice”.

- Sequence authorized by the DGII e-NCF, example: E310000000001

- Due date e-NCF Sequence, does not correspond to Electronic Consumption Invoice and Electronic Credit Note.

- Date of issue of the electronic invoice

- Invoice Summary includes details of charges and breakdown of totals.

- QR Code (Quick Response) where the recipient can check the status of his e-NCF.

- Security Code

- Date and time of the digital signature of the e-CF confirming the validity of the document.

- The title of the document will be “Nota de Crédito Electrónica” (Electronic Credit Note).

- e-NCF Sequence authorized by the DGII e-NCF, example: E340000000000

- Original invoice or e-NCF Modified, example: E3100000000000001

- Reason for Modification: Corrects amounts of the modified NCF

- Issue Date: 24-01-2023

It will display the same way, however, the text referring to Customs Duties has been changed to “Taxes, Duties and Government Charges” and additional charges to “FedEx Ancillary Charges”. Additionally, Tax charges will be reported under the non-billable amount field of the electronic invoice.

- All the electronic documents (XML) must have the type of voucher issued.

- All electronic documents (XML) except for Invoice of Consumption under $250,000 DOP, must include the RNC.

- The XML of the credit notes must have reference information of the original invoice.

- There will be other internal validations including calculation of charges, ITBIS, etc.

Customers will receive tax documents if they provide their e-mail address at the time of issuing their invoice. However, electronic receivers will be able to consult their tax documents through the web service enabled by the DGII if the taxpayer or electronic receiver has deposited the URL in the DGII portal desktop.