How to complete international shipping documentation

How do I complete a commercial invoice?

Overview

The commercial invoice is the primary document used by most foreign customs agencies for import control, valuation and duty determination.

As the shipment’s exporter, you’re responsible for providing the commercial invoice. Since it serves as the foundation for all other international shipping documents, it’s the first one you should complete. Customs officials use this document (and any other documents your shipment requires) to process your shipment, so it’s important to ensure that all of the information you provide is thorough and accurate.

The commercial invoice must be completed in English. The information that you provide on other international shipping documents, including the shipping label, must also be consistent with the information you provide on the commercial invoice. If you do not have your own company commercial invoice, please download our commercial invoice template in editable pdf format below.

Transmitting your customs documentation electronically via FedEx® Electronic Trade Documents (ETD) can help you avoid delays at customs. Getting started takes just a few simple steps.

When do I need a commercial invoice?

The commercial invoice is required for all international commodity shipments (excludes intra-EU). In other words, it’s required for any international shipment with a commercial value. Most non-document shipments are classified as commodity shipments.

Complete the following steps to fill in the commercial invoice:

1. International Air Waybill number

Enter the FedEx International Air Waybill number, our main reference for your shipment.

2. Export references (ie. order number, invoice number, etc.)

An invoice number is always required for customs

3. Shipper / Exporter

Complete name, address, telephone number, email address, and exporter’s EORI (Economic Operator Registration and Identification) and VAT/Tax ID number. Please note the shipper is the owner of the goods and this may differ to the pick-up address.

4. Consignee / Importer

Complete name, address, telephone number and importer’s EORI or Tax ID number.

5. Importer – if other than consignee

If the shipment will be handled by an importer who is not the recipient, the complete full name, address and telephone number of that importer.

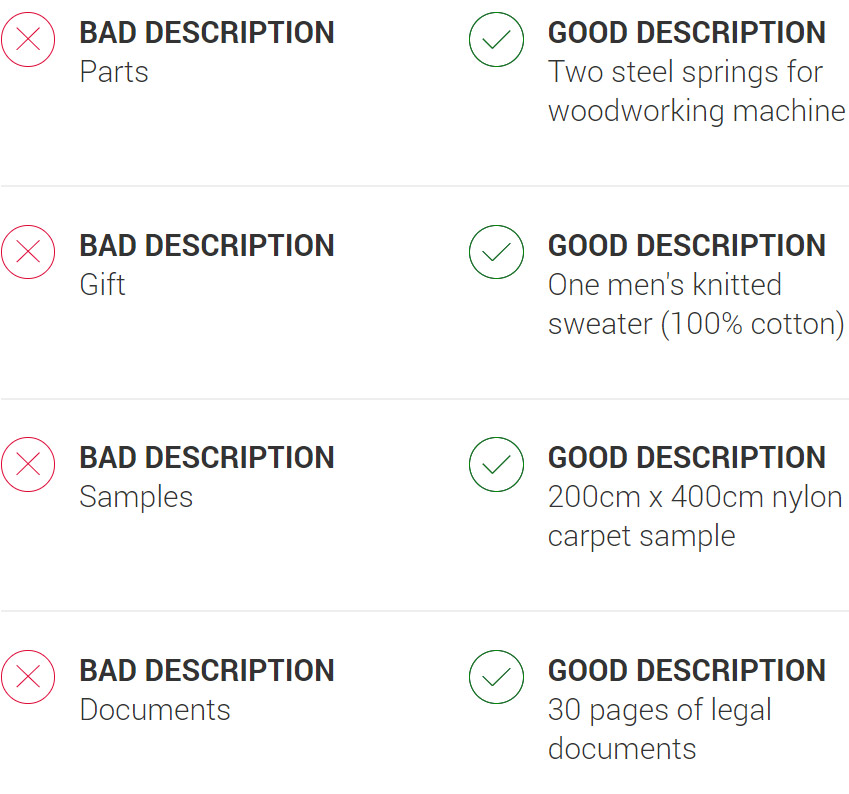

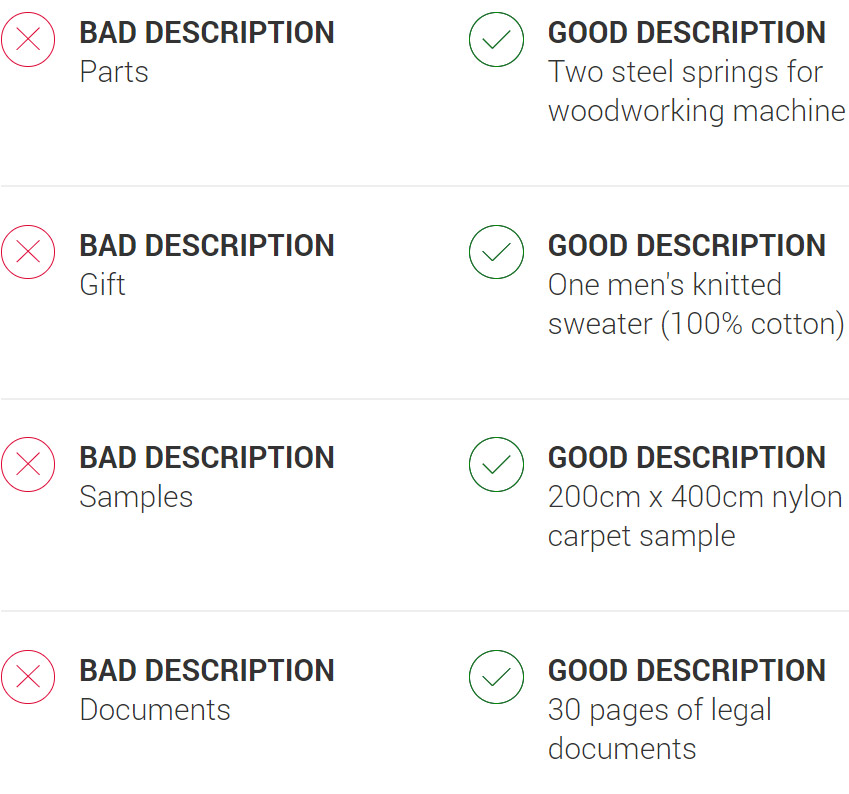

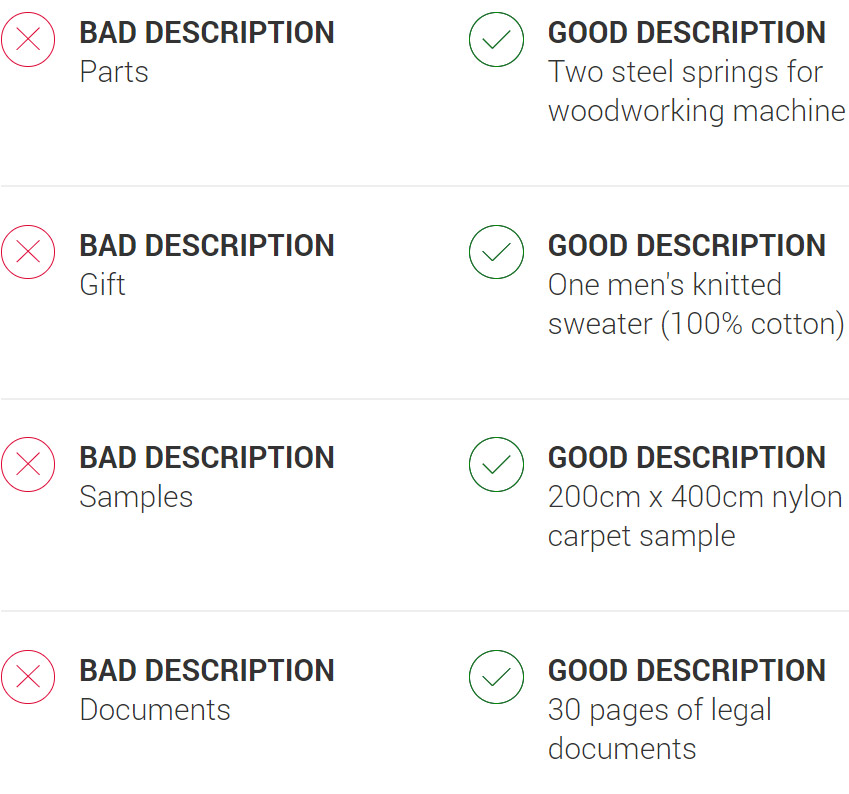

6. Full description of goods

Including an accurate description of your shipment’s contents is essential for timely customs clearance. Inaccurate or vague shipment descriptions are one of the most common reasons for customs delays. Include consistent, detailed descriptions on all documents to help keep your shipment on track.

The description should answer:

- What is it?

- How many are there?

- What is it made of?

- What is it intended for?

Please note: Separate descriptions must be provided for each type of commodity. For example, if you are shipping 15 identical jumpers and 30 identical pairs of trainers, you would need to include separate descriptions for the group of jumpers and the group of trainers.

Remember to also include the material composition breakdown e.g. 80% cotton and 20% polyester and check if you require any additional paperwork e.g. a footwear declaration is required for any footwear shipments to the U.S.

Including the correct Harmonized System (HS) code will help ensure the description of the goods is understood by the authorities in all countries.

FedEx International Shipping Assist can help you to quickly and accurately identify the HS code for your goods.

7. Country/Territory of Manufacture

Complete the country/territory in which each of the commodities in your shipment was originally manufactured or produced. If you have multiple commodities with different countries/territories of manufacture, please include each country/territory of manufacture beside each product description.

8. Unit Value

A true customs value is required, even if there is no transactional value for the goods being shipped. If you have multiple commodities with different values, please include each value beside each product description.

9. State the accurate weight of the shipment

It is essential and a legal requirement for Security and Customs Filing to include the accurate weight on the AWB and commercial invoice. You must include the gross and net weight for each line item of the goods, the measuring unit (e.g. KG) and the quantity (e.g. 4 items).

Please note: Your shipment will receive several scans during its journey, including weight and dimensional scans. If there are variances these may be adjusted and your shipping bill could reflect the changes. Providing the incorrect weight may result in higher-than-expected freight costs.

10. State the reason for shipping

This can help to reduce the risk of customs hold-ups and delays, but that’s not all. Some goods may be eligible for special customs procedures or even lower customs charges. This includes shipments that are sent as gifts, returns, repairs, samples or goods for testing. If the reason for shipping is not included, the receiver could pay higher customs charges than is necessary.

Don’t forget to include your Customs Procedure Code (CPC) if it’s known to you, this tells us the correct clearance process you need us to use.

11. Include the correct Incoterm®

Incoterms® or international commercial terms are a series of predefined commercial terms published by the International Chamber of Commerce (ICC) relating to international commercial law.

They’re a set of abbreviations used to determine who holds the risk on the shipment. By risk, we mean the responsibility of loss or damage or whose insurance could potentially be used for a claim.

12. Billing of duties and taxes

Duties, taxes and disbursement fee will be charged to the recipient by default, unless the shipper marks the ‘Bill Shipper’ option on the air waybill. If the recipient declines the shipment or refuses to pay, the shipper is ultimately liable for any duties, taxes and fees assessed on the shipment.

13. Check if your goods are eligible for duty-free import at destination

Depending on the destination country, your goods may be eligible for duty-free access at destination. The EU and the UK have a network of free trade agreements (FTAs) that enable duty-free access to third countries. To benefit, you may be required to complete additional documentation or to add a statement proving the origin of your goods to your commercial invoice.

14. Signature

Before you sign the declaration, ensure that all the information is consistent with the Air Waybill. Please place the original commercial invoice and two copies, all individually signed, on the package, together with the Air Waybill.

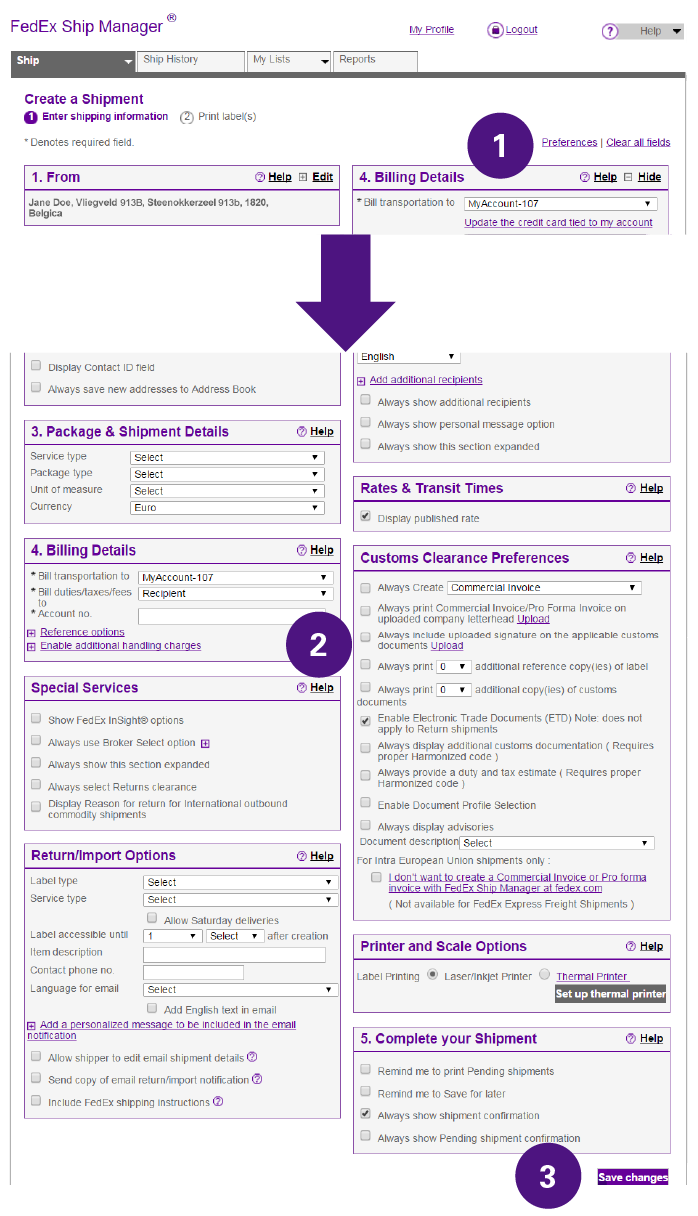

How to complete your Air Waybill online and upload your customs documentation with FedEx Ship Manager® at fedex.com

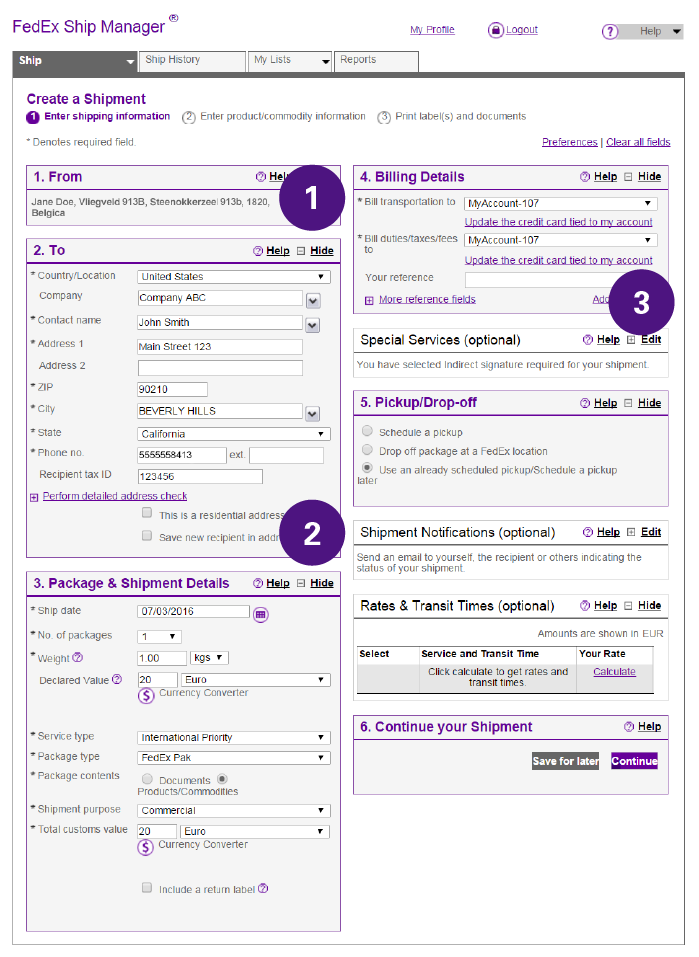

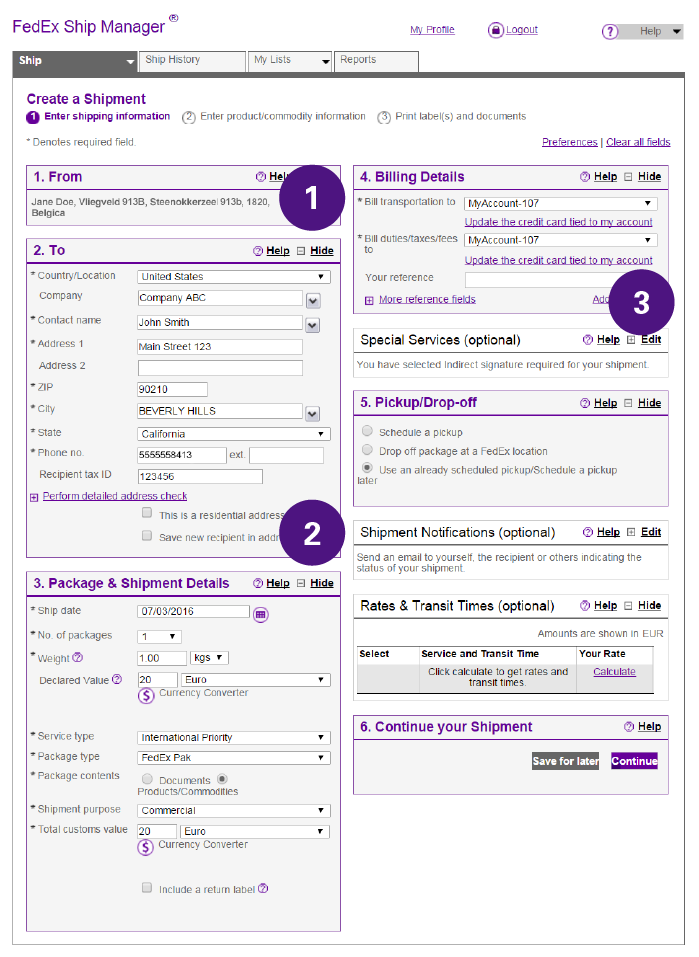

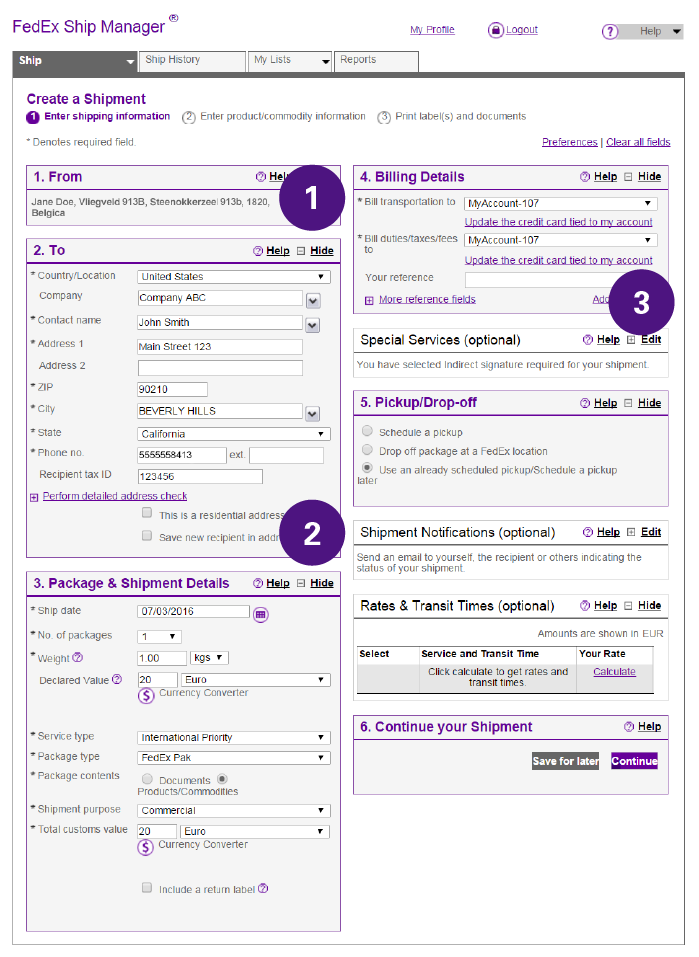

Sender Information

Be sure to complete your full address and phone number.

For commercial shipments travelling outside the European Union, make sure you include your EORI number.

Recipient Information

Complete the recipient’s address details and phone number.

For commercial shipments travelling outside the European Union, make sure you include the recipient’s tax ID /EORI number.

Payer Information

Complete the payer information for transportation and Duties & Taxes

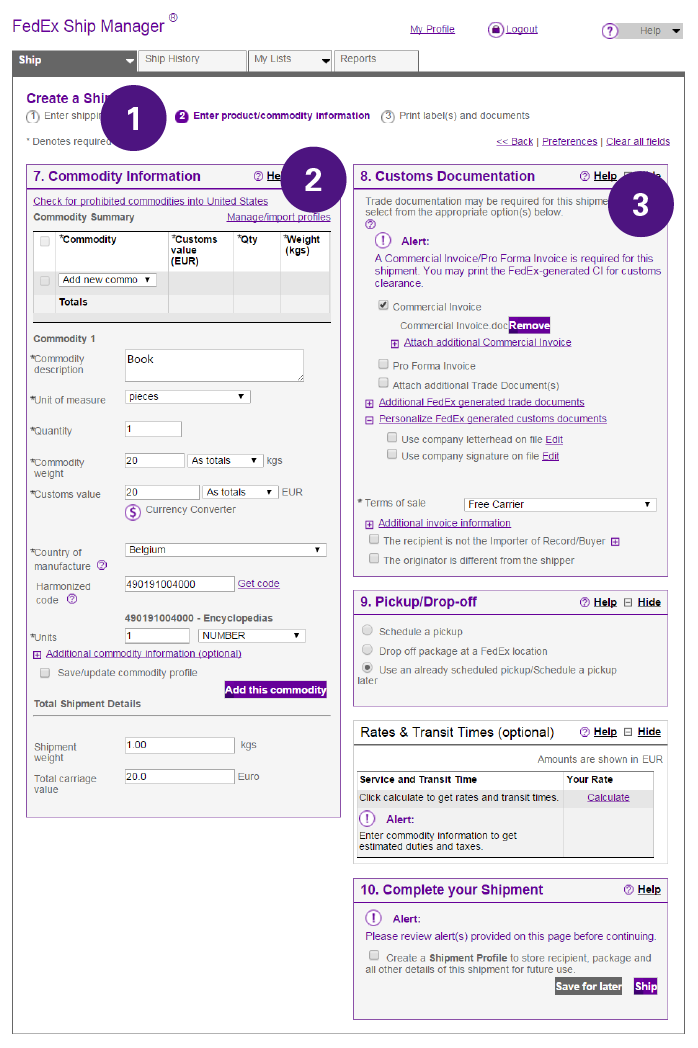

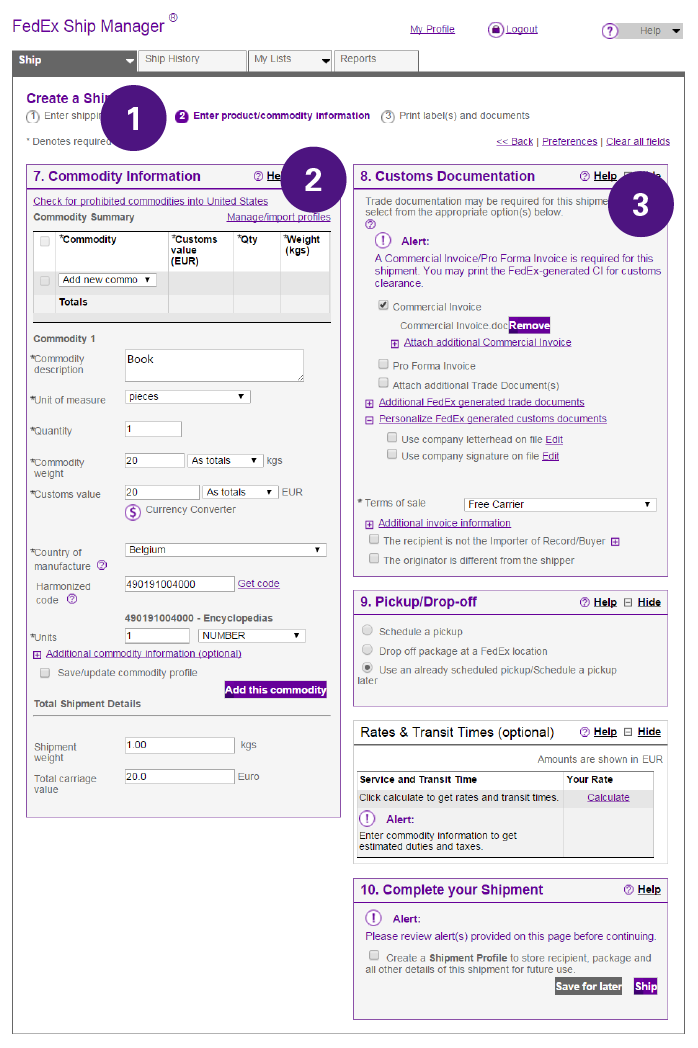

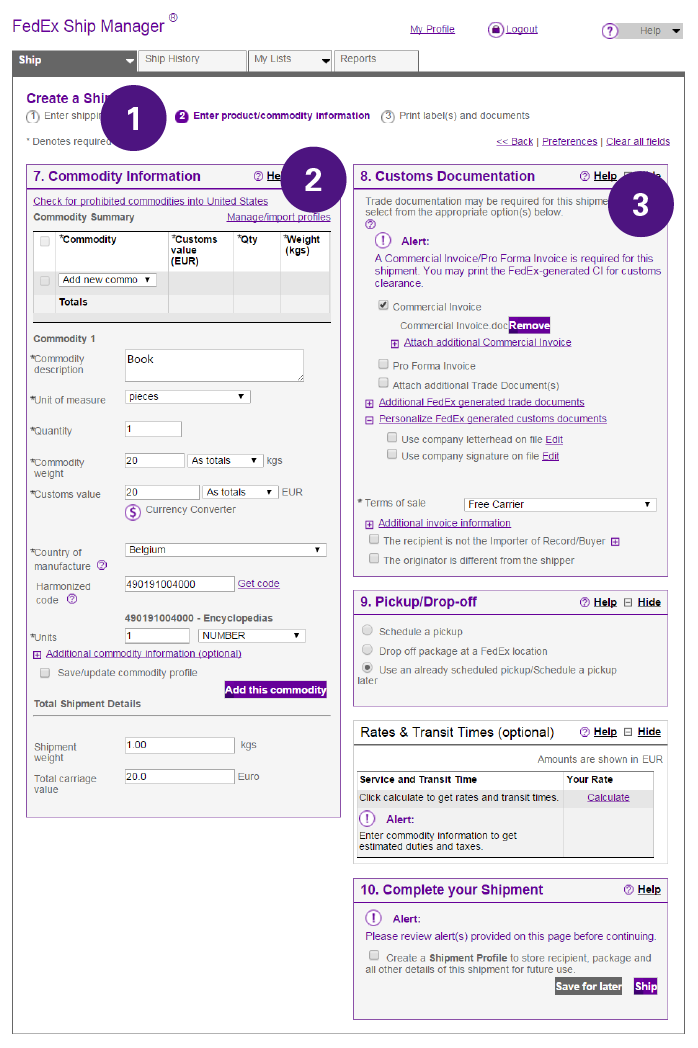

Enter product/commodity information

For shipments requiring customs documentation, a new window will appear to allow you to enter all your commodity information

Commodity Information

For each of the commodities in your shipment put:

- Full description of goods in English

- What it is?

- What it is made of?

- How many/how much?

- What it is used for?

- Customs Value: A value of customs is required, even if there is no transactional value for the goods being shipped (Zero value is not acceptable)

- Country/Territory of Manufacture: If you have multiple commodities with different countries/territories of manufacture, please include each country/territory of manufacture for each product description

- Full description of goods in English

Choose the basic customs documents you want to upload or create

- Commercial Invoice

- Our recommendation: Use your own commercial invoice

- Make sure you have enabled Electronic Trade Documents to upload your documentation electronically

- Make sure that the information in the Commercial Invoice matches the information on the Air Waybill

- Pro forma Invoice

- For shipments of free goods such as product samples, catalogues or products not intended for sale

- However, not all countries/territories accept pro-forma invoices and we recommend preparing a commercial invoice in every case as it requires no extra effort

- Additional Trade documents

- Attach any other required trade documents required for your commodity / destination

- Commercial Invoice

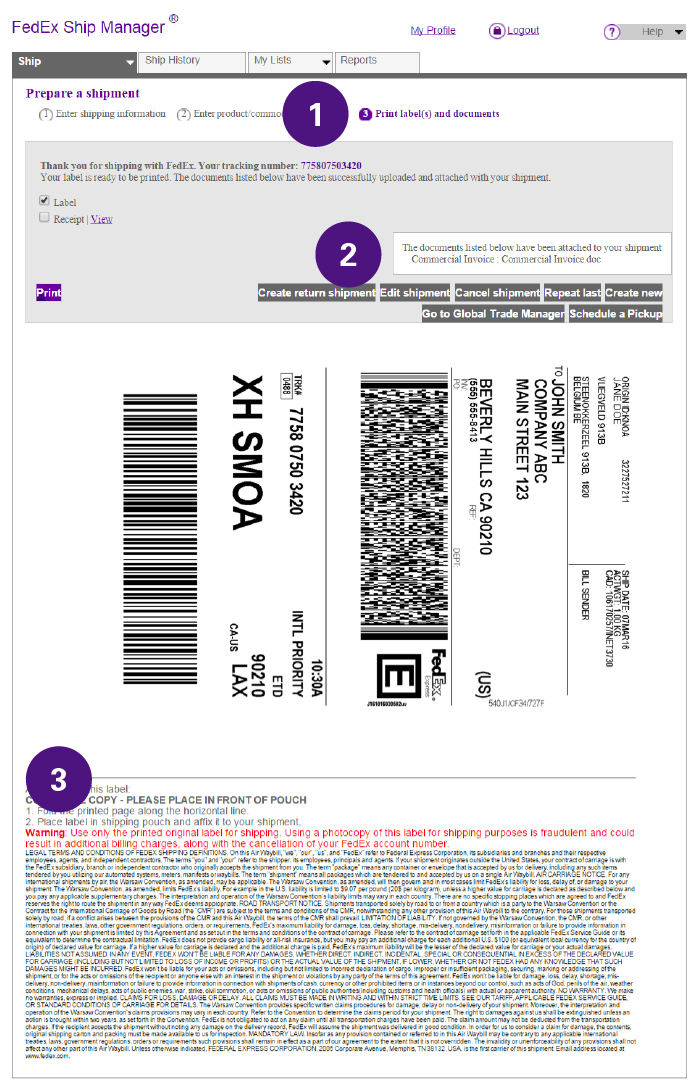

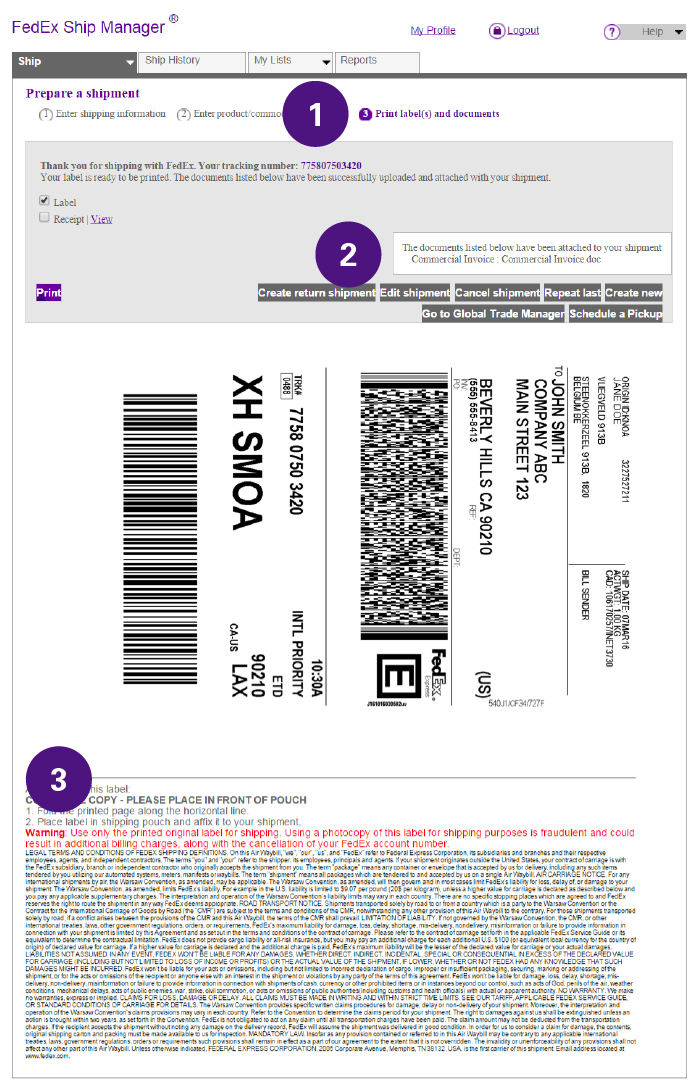

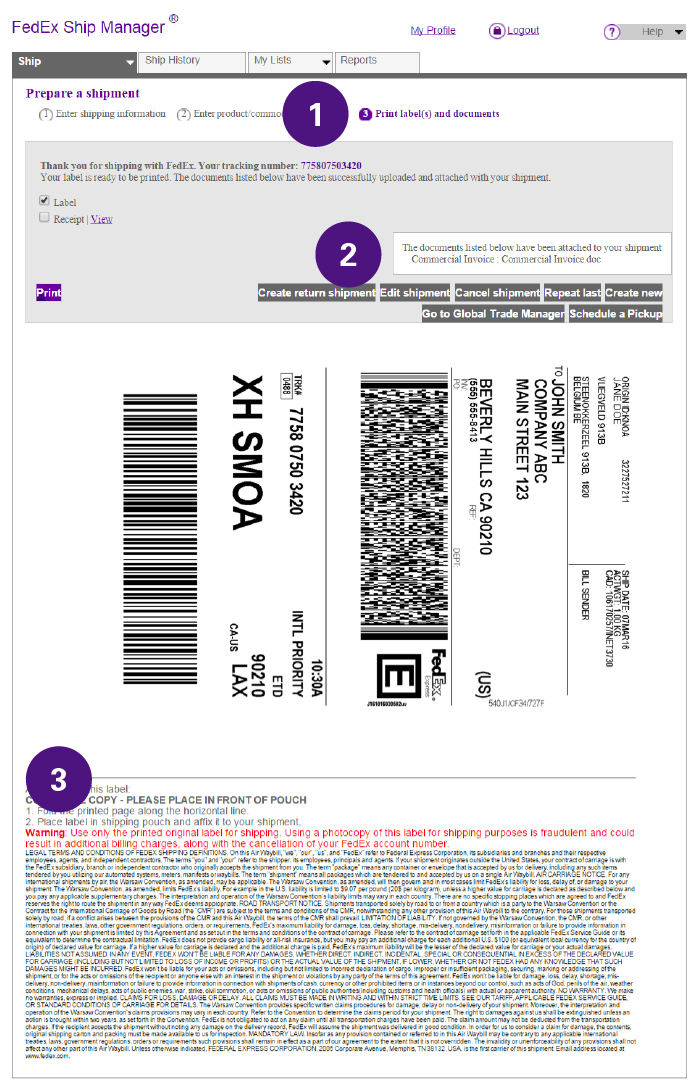

Print labels and documents

Last step in the process is the verification and printing of your Air Waybill

Documents attached

You have the ability to view the documents that have been attached to your shipment

After printing instructions

Fold the printed page along the horizontal line

Place the label in the shipping pouch and affix it to your shipment

Note: If you have not uploaded your Commercial Invoice in FedEx Ship Manager®, please print three copies of your Commercial Invoice, sign them and put them on your shipment together with the Air Waybill

Additional tips and customs resources

Customs for importers

Learn what’s required from a receiver to help ensure shipments arrive without delay.

Customs for exporters

See the steps that you and FedEx must take to help your goods clear customs smoothly.

Ready to ship?

Log-in to the new FedEx Ship Manager® a faster, easier, more automated way to ship.