The European Union (EU) made some important changes to its Value-Added Tax (VAT) rules on July 1, 2021.

Which businesses will these changes affect?

These changes could affect all businesses selling to the EU; however, they will mostly affect businesses making direct business-to-consumer sales, as well as those selling to consumers via online marketplaces.*

These changes could lead to simpler procedures and reduced administration. There could also be broader implications for the way you conduct business into the EU.

The three biggest changes are:

The United Kingdom (UK) has already introduced changes to its VAT rules in January 2021, following its departure from the EU. For more information on these changes, please download our overview guide.

1. Removal of the EUR 22 import VAT exemption

What does it mean?

Beginning July 1, 2021, VAT will be charged on all commercial goods imported into the EU, regardless of value. For shipments with a value of EUR 150 or below, this can either be charged at the time of the sale by using the new Import One-Stop Shop (IOSS), or be collected from the end-customer by the customs declarant (FedEx).

How might it affect my business?

If your business is based outside the EU, it will no longer be able to export shipments valued under EUR 22 to consumers in the EU free of VAT.

How might it work in practice?

Scenario

An online business in China sells one pair of socks worth EUR 10 to an EU-based consumer.

Before July 1, 2021

The shipment can be imported into the EU free of VAT, since the total value of the goods is less than EUR 22.

After July 1, 2021

VAT will apply to all shipments regardless of value. VAT will apply at the rate set in the buyer’s country of residence.

2. Introduction of an Import One-Stop Shop (IOSS)

What does it mean?

For e-commerce shipments valued at EUR 150 or below, the EU is introducing an optional Import One-Stop Shop (IOSS) to clear goods through customs. This will allow sellers or online marketplaces to charge VAT at the point of sale and remit it directly to the authorities. This can make the process simpler and more transparent for the consumer, and helps to ensure efficient customs procedures.

If the IOSS is not used, FedEx will collect the VAT from the customer prior to delivery and pay it to the authorities.

How might it affect my business?

To sign up to the IOSS, most non-EU sellers will have to appoint an intermediary to register and declare the VAT on their behalf, unless they are established in the EU themselves. They will then need to provide their IOSS number to the customs declarant (FedEx).

VAT for their business-to-consumer sales imported into the EU will be submitted via a monthly tax return in the nominated EU member state, which will then forward the VAT declaration and payment to the tax authorities in the EU destination countries. As a consequence, businesses will no longer have to register for VAT in every EU country they sell in.

How might it work in practice?

Scenario

A Canadian e-commerce business sells electronics with a value of less than EUR 150 to customers in five EU countries.

Before July 1, 2021

The Canadian e-commerce business is obliged to register and account for VAT in each EU country.

After July 1, 2021

The Canadian e-commerce business can choose to close its foreign VAT registrations and register for IOSS in one EU country, charging VAT at the point of supply. Or the business can continue as they do today, with their customers paying VAT on importation.

3. Certain online marketplaces becoming the VAT collector

What does it mean?

Marketplaces in scope of the new EU VAT rules can, for instance, be online platforms that facilitate the sales transaction. They enable sellers to sell their goods directly to customers.

Certain marketplaces, rather than their sellers, will now be responsible for collecting, reporting and remitting the VAT due from the end-consumer if they register with the IOSS. The scheme would apply for sellers for transactions up to EUR 150.

How might it affect my business?

If a marketplace has opted for the IOSS, businesses selling through it must use the marketplace’s IOSS number and provide it to the party responsible for making the customs declaration (FedEx).

Businesses using several marketplaces to sell their goods must provide the corresponding IOSS number for each sale to the customs declarant.

How might it work in practice?

Scenario

An e-commerce business based in China sells a EUR 90 vase to an EU customer, via a qualifying online marketplace that opted for the IOSS.

Before July 1, 2021

The customer buying the vase from the seller is responsible for paying the VAT on their purchase at the time of importation.

After July 1, 2021

The marketplace the vase is being sold through uses the IOSS and becomes responsible for collecting the VAT from the customer at the time of sale, ensuring it is passed to the relevant authorities.

Your IOSS questions answered:

FedEx has been working with KPMG to design an IOSS solution to support FedEx Express customers established outside the EU. After signing up for KPMG services, KPMG will handle your IOSS number registration, as well as prepare and submit your monthly IOSS return, once you have obtained your IOSS number.

For additional details, please visit the KPMG IOSS Portal.

You can use the following checklist to help you easily identify whether your shipment may be eligible under the IOSS:

- Was the sale made on your own e-commerce website?*

- Is the shipment to an individual consumer, not a business?

- Are the goods being imported into the EU from a non-EU country?

- Is the total value of the shipment EUR 150 or less?

- Can the goods be shipped without being subject to excise duty?

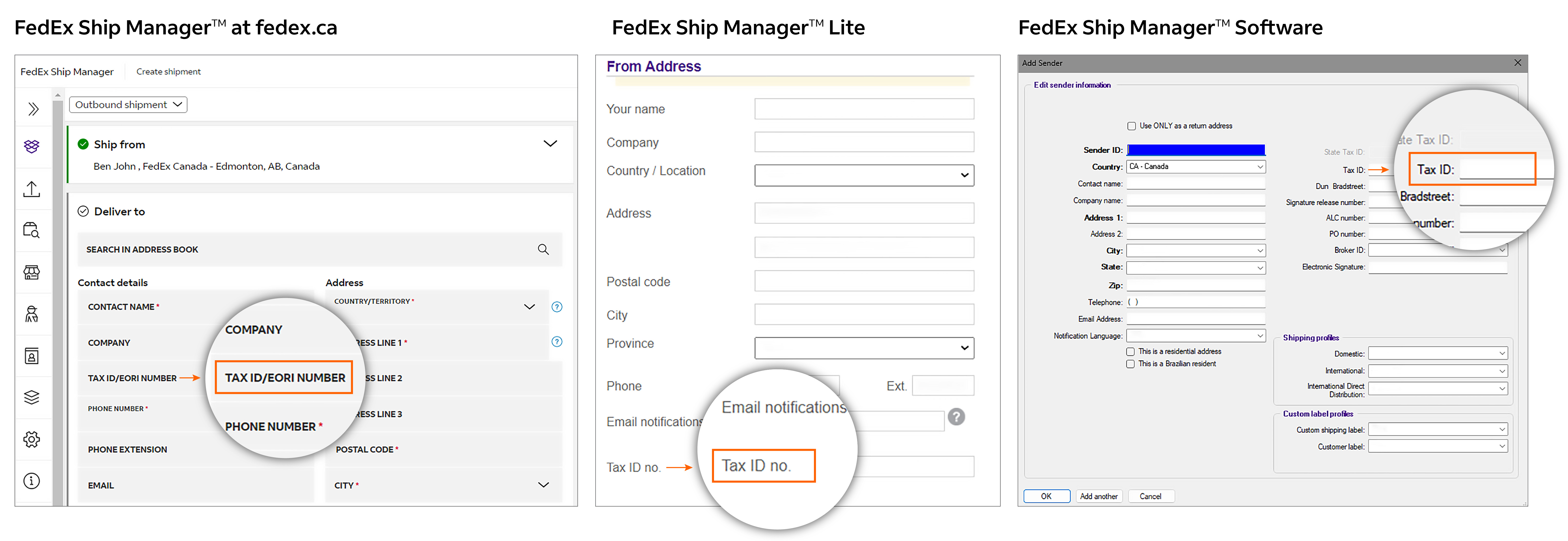

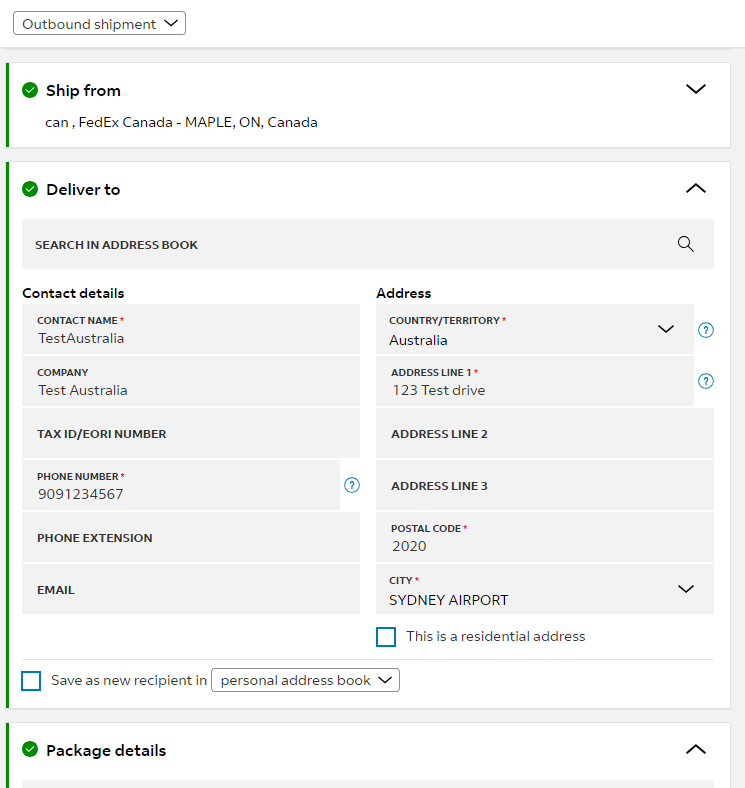

- Did you process the shipment using a FedEx electronic shipping solution?

- Did you add your 12-character IOSS number without additional letters, numbers or other characters in the Sender or Recipient Tax ID field when processing your shipment (e.g., “AB1425364758”, not “IOSS AB1425364758)?

- If you are shipping to a business address, did you ensure that the address does not include a company name?

*If a sale is made via an IOSS-registered online marketplace, the 12-character IOSS number of the online marketplace must be provided. You cannot use your own IOSS number for sales made via a marketplace.

The IOSS can be used for business-to-consumer shipments imported into the EU from non-EU countries that are valued at EUR 150 or less and not subject to excise duty.

You will need to enter your IOSS number when processing your shipment using one of our electronic shipping solutions. You can enter your 12-character IOSS number in the Sender or Recipient Tax ID field. Do not add any additional letters, numbers or other characters — such as adding “IOSS” to the beginning.

If your sales are made via an IOSS-registered marketplace, you must provide the marketplace’s IOSS number instead. You can’t use your own IOSS number for sales made via a marketplace.

FedEx can only accept an IOSS number via a proprietary FedEx electronic shipping solution or a FedEx Compatible solution. You cannot submit manual Air Waybills when using the IOSS.

| If you use Modernized FedEx Ship ManagerTM at fedex.com or MyTNT2, enter your IOSS number into the Shipper or Sender Tax ID field. |

| If you use Toolbox, enter your IOSS number in the VAT field. |

| If you use Global Ship Manager software, enter your IOSS number in the VAT/Customs ID field. |

| If you use FedEx Web Services, enter your IOSS number in the TIN field. |

| If you use TNT ExpressConnect, enter your IOSS number in the VAT field. |

| If you use our integrated solution to create an EDI TNT NFF data file, enter your IOSS number into the VAT field. |

| If you use a TNT EDI Customised solution to ship, you will need to contact your sales representative who will request that someone from our Customer Technology team contacts you. |

| If you use your own system integrated with one of our standard tools, you may need to adjust the mapping of your data to the relevant field. If required, contact your sales representative who will request that someone from our Customer Technology team contacts you. |

| If you ship via a Third Party Provider, you should contact your provider and they will supply the details for your platform. |

Please note that beginning July 1, 2021, all shipments/commodities imported into the EU require a value for customs and a Commercial Invoice, except “documents”. Please ensure you show an accurate value of the goods in the “customs value field” on the Air Waybill, excluding freight and other charges.

For business-to-consumer shipments going through the IOSS, it is also recommended to include the sales price in euros (€) on the Commercial Invoice to avoid exchange rate differences at the time of import.

If you need to have your goods returned outside the EU, a new FedEx Air Waybill will need to be created with a reference to the old AWB included in the description field and clearly marked as a return shipment.

If you do not opt into the IOSS, then FedEx will pay the import VAT on your behalf using our own deferment account to help deliver your shipment as quickly as possible. Please note that we will then invoice this amount to the recipient and this incurs an administration fee. This will either be a Pre-Payment fee or a Disbursement fee (which are part of our ancillary charges). Please see our ancillary clearance service fees page to see the charge at destination country.

Please also note that you may register your company directly with the IOSS without using the services of an intermediary, provided that you are established in the EU.

To sign up for the Import One-Stop Shop (IOSS), businesses should register on the IOSS portal of an EU Member State beginning April 1, 2021. Businesses not already established in the EU will normally need to appoint an EU-established intermediary to fulfill the VAT obligations. More details on using the IOSS and the other important changes to the EU’s VAT rules are available from the Publications Office of the European Union.

*EU countries are: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, The Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

Please note that, under the terms of the EU-UK Joint Protocol, Northern Ireland will remain part of the EU VAT area for goods. This means that these new provisions will also apply to goods imported into Northern Ireland from the rest of the world.

The information provided does not, and is not intended to, constitute legal and/or tax advice; instead, this information is for general informational purposes only. This information may not constitute the most up-to-date legal or other information. Readers of this information should contact their own advisor to obtain advice with respect to any particular legal and/or tax matter. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this posting is provided “as is”; no representations are made that the content is error-free.