Understanding Customs Tariffs: Stay up-to-date on recent changes that could impact your shipments.

Background

On July 1, 2020, the Canada-United States-Mexico Agreement (CUSMA) / United States-Mexico-Canada Agreement (USMCA) / Tratado entre México, Estados Unidos y Canadá (T-MEC) came into force. This agreement modernized the North American Free Trade Agreement (NAFTA) by addressing trade challenges in key industries, such as agriculture and automotive, and making improvements to better facilitate the free flow of goods between all three countries. Provisions were included to address important issues related to intellectual property, labour standards, gender equality, Indigenous Peoples’ rights, and more.

Proof of Origin Requirements

In order to claim the preferential tariff treatment for each country under CUSMA/USMCA/T-MEC, a set of data elements referred to as a ‘certification origin’ must be provided by the exporter, producer or importer of the goods by adding the information to any document (e.g., Commercial Invoice) accompanying the shipment or, if preferred, by providing it on a separate document. In addition, the imported goods must originate* and be exported from a CUSMA/USMCA/T-MEC country.

The 'Certification of Origin' can be completed in English, French, or Spanish and will not follow a prescribed format; however, the following minimum data elements must be included:

1. Indicate the Certifier (Importer, Exporter or Producer)

Please note that Mexico only accepts the ‘Importer’ as the Certifier, for goods imported into Mexico.

2. Name, Address (including country) and Contact Information of the Certifier

3. Name, Address and Contact Information of the Exporter (if different from the certifier)

4. Name, Address and Contact Information of the Producer (if different from the certifier, or exporter)

5. Name, Address and Contact Information of the Importer

6. Description and HS Tariff Classification (6-digit level) for the Goods (include invoice number, if known)

7. Origin Criterion for the Goods, as set out in Article 4.2: Originating Goods of the CUSMA Rules of Origin

8. Blanket Period (date range up to 1 calendar year)

9. Authorized Signature and Date

The certification* must be signed and dated by the certifier and accompanied by the following statement:

“I certify that the goods described in this document qualify as originating and the information contained in this document is true and accurate. I assume responsibility for proving such representations and agree to maintain and present upon request or to make available during a verification visit, documentation necessary to support this certification."

In lieu of the Certification of Origin, FedEx will accept the following low-value certifying statement for commercial shipments valued below CAD$3300 (**see chart below).

“I hereby certify that the goods covered by this shipment qualifies as an originating good for the purposes of preferential treatment under USMCA/T-MEC/CUSMA.”

Certification of Origin

FedEx Express has created a Certification of Origin form (fillable PDF) that contains the required data elements to claim preferential treatment under CUSMA. The certifier must complete the form, sign and date it, and then either upload it using FedEx® Electronic Trade Documents or print and apply it directly to the shipment.

Blanket Certification of Origin

Please email your blanket Certification of Origin for FedEx Express shipments imported into Canada to Federal Express Canada Corporation at fta-canada@fedex.com.

Commercial Invoice - Certification of Origin

FedEx Express has also created a Commercial Invoice - Certification of Origin form (fillable PDF) that contains the required data elements and certifying statement to claim preferential treatment under CUSMA. The certifier must complete the form, sign and date it, and then either upload it using FedEx® Electronic Trade Documents or print and apply it directly to the shipment.

| CA Imports | US Imports | MX Imports | |

| CUSMA/USMCA/T-MEC Certification of Origin | Replaced the NAFTA ‘Certificate of Origin’ proof of origin requirement. | ||

| *Increased De Minimis (the monetary value below which qualifying shipments are free from duties, taxes, or formal customs import procedures) |

Shipments with a value below the de minimis threshold are exempt from providing a certification of origin for express courier shipments (postal shipments not included) imported directly from a USMCA or T-MEC country, regardless of the country of origin, as follows;

|

The U.S. de minimis threshold is USD$800 |

The value threshold for the tax rate of USD$50 applies to express and postal shipments imported directly from any country, regardless of the country of origin, as follows;

|

| **Proof of Origin - Commercial Goods |

Shipments with a value less than CAD$3300 are exempt from providing a certification of origin; however, a statement certifying that the imported goods originate from a USMCA or T-MEC country, is required. |

The Certification of Origin is not required for shipments valued at less than USD$2500; however, a low-value CUSMA or T-MEC statement is required. Note that FedEx requires a Certification of Origin, regardless of the shipment value, for goods that require formal entries for clearance (e.g., subject to quota limitations or anti-dumping and countervailing duties) | The Certification of Origin for shipments valued at less than USD$1000 is not required; however, a low-value CUSMA or USMCA statement may be required. |

| Proof of Origin - Casual goods (other than for sale or for commercial use) | A certification of origin is not required; however, the country of origin for these imports must be from a USMCA or T-MEC country and clearly marked on any accompanying supporting documents (e.g., Commercial Invoice and/or air waybill) to benefit from the preferential tariff treatment. | Same as ‘Commercial Goods’. Proof of Origin requirements are based on value thresholds and not the ‘end-use’/purpose of the imported goods. | In principle, same as ‘Commercial Goods’. Proof of origin requirements are based on value thresholds and not the ‘end-use’/purpose of the imported goods. Simplified customs clearance is not available for commercial goods. |

| Low Value Shipment (LVS) Value Threshold | Shipments imported with a value below the CAD$3,300 LVS threshold (containing goods that are not regulated, controlled or prohibited) do not require formal entries to be submitted for customs clearance. | Shipments imported with a value below the USD$2,500 formal value threshold (containing goods that are not regulated, controlled or prohibited) do not require formal entries to be submitted for customs clearance. | The value threshold for express consignments is USD$1,000. A separate method exists for personal/individual imports with a threshold of USD$5,000 for an individual who does not have an importer’s registry, and no limit for individuals who hold a valid importer’s registry. |

| New Tariff Rate Quotas (TRQs) | TRQs will be phased in over an agreed-upon period of years to increase market access to specified agricultural products such as dairy, poultry and eggs. | The US will provide reciprocal access on a tonne-for-tonne basis for imports of specified Canadian dairy products through first-come, first-served TRQs. | Modification to market access on commodities such as automobiles, steel and aluminum will be phased in over a period of agreed-upon years. |

| Automotive Industry – New country of origin rules and labour provisions for manufacturing |

These include, but are not limited to, the following:

|

||

| Textile and Apparel Goods - Tariff Preference Levels (TPL) | Commitments previously established under NAFTA have been largely maintained with CUSMA. The quota decreased for wool apparel from the US and increased for cotton/man-made fiber apparel from the US. | US commitments previously established under NAFTA have been largely maintained with USMCA. There are decreases to quota levels for cotton/man-made apparel and wool from CA, while the quota levels for such imports from MX have stayed the same. | Commitments previously established under NAFTA have been largely maintained with T-MEC. The quota will decrease for fibres not made or obtained in Mexico (e.g., silk). |

All information is subject to change and updates will be provided as more information becomes available.

Next Steps for Importing into Canada

1. FedEx strongly recommends that importers/exporters/producers re-evaluate and re-certify their goods to ensure they qualify for preferential treatment under the new agreement (e.g., Rules of Origin).

2. Current NAFTA certificates should be replaced with the equivalent ‘Certification of Origin’ required under the new CUSMA/USMCA/T-MEC.

3. Current processes will need to be updated to ensure that the new ‘Certification of Origin’ is either referenced on, and/or is provided with the accompanying shipment documentation.

4. Advanced rulings for origin under the new CUSMA/USMCA/T-MEC must be obtained. NAFTA origin advance rulings will not be valid once the new agreement comes into force.

The New NAFTA - CUSMA/USMCA/T-MEC

Get an overview of the key changes, including the new data elements, Certification of Origin document and more.

The New NAFTA - CUSMA/USMCA/T-MEC

Get an overview of the key changes, including the new data elements, Certification of Origin document and more.

Shipping with FedEx under CUSMA

You can quickly and easily prepare your shipping labels and Certification of Origin for your CUSMA/USMCA/T-MEC shipments using your FedEx electronic shipping solution and FedEx® Electronic Trade Documents. Please find your FedEx electronic shipping solution below and follow the steps.

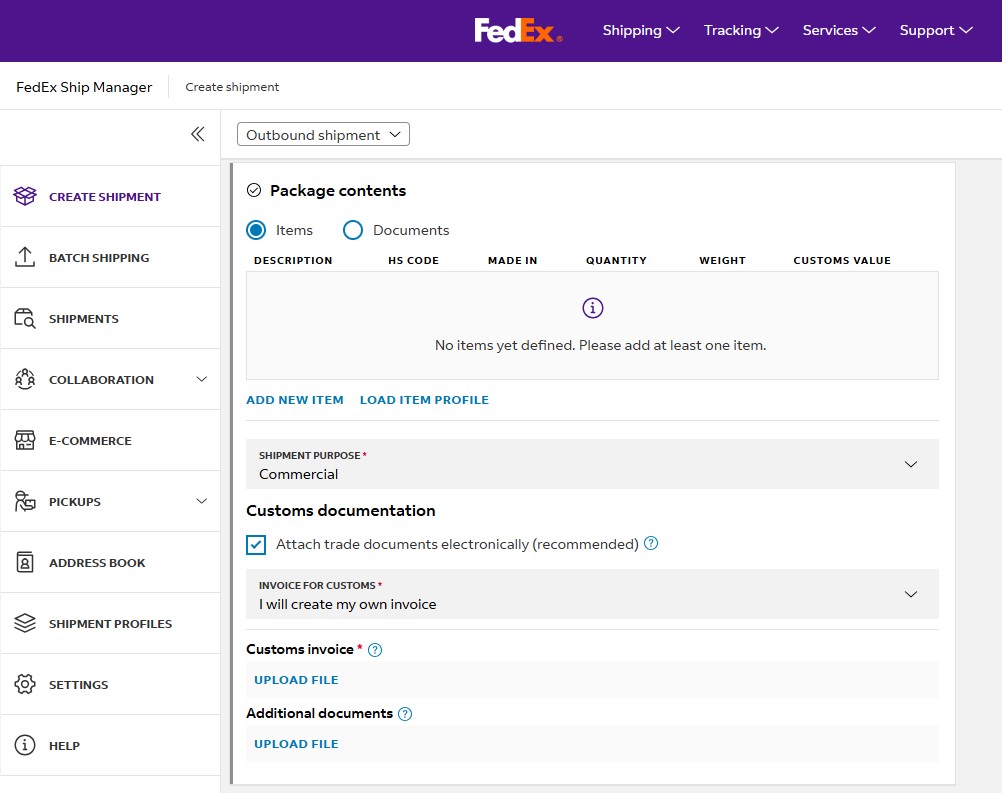

FedEx Ship Manager™at fedex.ca

- When CUSMA Certification of Origin is required, follow the prompts to create shipping labels.

- Download and complete the CUSMA/USMCA/T-MEC Certification of Origin document online.

- Sign (electronic signatures accepted), and date the document.

- When creating your shipment in FedEx Ship Manager™ at fedex.ca, navigate to the Package Contents section. Select the ‘Attached trade documents electronically’ checkbox. Click “Upload file” under the corresponding heading to upload your completed CUSMA Certification of Origin and any other required documents.

FedEx Ship Manager™ Software and FedEx Ship Manager™ Server

- Dispose of the invalid NAFTA Certificate of Origin document (prints automatically if auto-generate is selected when creating the shipping label).

- Download and complete the CUSMA/USMCA/T-MEC Certification of Origin document online.

- Sign (electronic signatures accepted), and date the document.

- Upload the completed document using FedEx Electronic Trade Documents and select “add other trade documents”, or print and attach to your package.

Please note that generating the CUSMA Certification of Origin requires the 2020 FedEx Ship Manager general release or later.

FedEx Web Services

- Download and complete the CUSMA/USMCA/T-MEC Certification of Origin document online.

- Sign (electronic signatures accepted), and date the document.

- Upload the completed document using FedEx Electronic Trade Documents and select “attach additional trade documents”, or print and attach to your package.

FedEx Ship Manager™at fedex.ca and FedEx Ship Manager™Lite

Beginning July 1, 2020:

1. When CUSMA Certification of Origin is required, follow the prompts to create shipping labels.

2. Download and complete the CUSMA/USMCA/T-MEC Certification of Origin document online.

3. Sign (electronic signatures accepted), and date the document.

4. Upload the completed document using FedEx Electronic Trade Documents and select “attach additional trade documents”, or print and attach to your package. Please note that Step 4 only applies to FedEx Ship Manager at fedex.ca, not FedEx Ship Manager Lite.

FedEx Ship Manager™ Software and FedEx Ship Manager™ Server

Beginning July 1, 2020:

1. Dispose of the invalid NAFTA Certificate of Origin document (prints automatically if auto- generate is selected when creating the shipping label).

2. Download and complete the CUSMA/USMCA/T-MEC Certification of Origin document online.

3. Sign (electronic signatures accepted), and date the document.

4. Upload the completed document using FedEx Electronic Trade Documents and select “add other trade documents”, or print and attach to your package.

Beginning with the 2020 FSMS General Release, FedEx will replace the NAFTA COO and generate the USMCA/T-MEC/CUSMA Certification of Origin document.

Beginning with the 2020 FSM General Release, FedEx will replace the NAFTA COO with an editable USMCA/T-MEC/CUSMA Certification of Origin document.

FedEx Web Services

Beginning July 1, 2020:

1. Download and complete the CUSMA/USMCA/T-MEC Certification of Origin document online.

2. Sign (electronic signatures accepted), and date the document.

3. Upload the completed document using FedEx Electronic Trade Documents and select “attach additional trade documents”, or print and attach to your package.

Additional Resources

CUSMA – Full Text of the Agreement