Export Declaration Requirements

If you’re a Canadian exporter, you must electronically report all goods that require an export declaration to the Canada Border Services Agency (CBSA) prior to export.

You can file your export Declarations electronically by using the Canadian Export Reporting System (CERS), which is a free, web-based, self-service portal that enables exporters to submit electronic declarations (including Summary Reporting Program monthly reports) to the CBSA. Alternatively, you can also file your export declarations using G7 Electronic Data Interchange (EDI) Export Reporting.

Getting started with G7 EDI Export Reporting

The CBSA has provided the following steps for registration on their G7 - EDI Export Reporting page.

Step 1: Confirm that you have designated your business number as "export" or "both import and export" by contacting the Canada Revenue Agency (CRA) at 1-800-959-5525.

Step 2: Complete the registration form BSF158, Application for G7 Electronic Data Interchange (EDI) Export Reporting.

Step 3: Email the completed form to cbsa.export_program-programme_exportation.asfc@cbsa-asfc.gc.ca.

Step 4: The CBSA will respond by assigning you a license number, authorization ID number, and an EDI Memorandum of Understanding (MOU) for G7 EDI Export Reporting.

Step 5: Review and sign the MOU for G7 EDI Export Reporting, confirming that you agree to the CBSA's established standards and conditions as an EDI participant.

Step 6: Submit the signed MOU via email to tccu-ustcc@cbsa-asfc.gc.ca.

Step 7: For those customs service providers or exporters who are transmitting G7 EDI export declarations directly, the CBSA will also send you a G7 export acceptance test package by email to confirm that you have properly transmitted your G7 EDI export declarations to the CBSA.

Step 8: Registered and tested exporter or customs service providers accounts can begin submitting export declarations using the G7 EDI Export Reporting method.

Providing Verification to FedEx Express

Exporters are required to provide verification that an electronic export declaration was submitted to the CBSA when tendering a shipment to FedEx Express. The following verification is acceptable:

a copy of the completed electronic export declaration submitted to the CBSA

the Proof of Report (POR) number from the completed electronic export declaration, must be included on the FedEx Express International Air Waybill (‘Canada Export Declaration’ section) or Shipping Label

the applicable No Declaration is Required (NDR) exemption code for the goods being shipped (see FAQs below), must be included on the FedEx Express International Air Waybill (‘Canada Export Declaration’ section) or Shipping Label.

- An export declaration must be completed and submitted, prior to export, for commercial goods that are valued at CAD 2,000 or more destined to any country other than the U.S., Puerto Rico or the U.S. Virgin Islands.

- An export declaration must be completed and submitted, prior to export, for controlled, regulated or prohibited goods, regardless of value, for commercial goods destined to any country other than the U.S., Puerto Rico or the U.S. Virgin Islands.

Helpful Reminders

- Goods transiting the U.S. destined to Rest of World that meet the above criteria must also be reported on an export declaration.

- Be aware of fluctuating exchange rates to ensure that the CAD 2,000 value is met.

Please refer to the chart below for the export document requirements.

| Type of Goods | U.S. Destinations (including Puerto Rico and the U.S. Virgin Islands) |

All Other Destinations |

|---|---|---|

| Non-restricted goods |

Export declaration is not required | Export declaration is required for commercial goods valued at CAD 2,000 or more |

| Restricted goods – (i.e., controlled, regulated or prohibited) |

Export declaration is not required Permits, certificates, licenses or any documents required by other government departments, if applicable |

Export declaration is required for all goods, regardless of value Permits, certificates, licenses or any documents required by other government departments, if applicable |

Note: Any required permits, certificates or licenses must be submitted to the CBSA prior to the goods leaving Canada.

For a step-by-step exporting guide, please visit the CBSA website.

For more information on exporting from Canada, please visit the Global Affairs Canada website and the Customs D20 Series Memoranda.

Electronic declarations should be submitted to the CBSA using the Canadian Export Reporting System (CERS). Some of the advantages include:

Secure transmission of export declarations and summary reports to the (CBSA)

Data validation before you declare your exports

Easy access to your declaration submission history

Easy access to online help and reference materials

Or, you can use the G7 Electronic Data Interchange (EDI).

Responsibilities

New exporters must obtain their Canada Revenue Agency (CRA) Business Number (BN) and CBSA Export Program (RM) Account before registering for either CERS or G7-EDI export reporting. Resident Canadian exporters must obtain both their BN and exporter RM through the CARM Client Portal (CCP). Non-resident exporters must obtain their BN through the CRA (see business number registration process), and obtain their exporter RM through the CCP.

As the exporter, you are fully responsible for filing the Export Declaration and/or Export Permit and for the fines associated with non-compliance. FedEx is not responsible for any Export Declaration and/or Export Permit documents that may be lost, stolen, or damaged during transportation.

The CBSA mandates that controls must be in place to meet its export record-keeping regulations. Export records, including the proof of reporting, must be kept for a period of six years following the year of export. CERS is not a record-keeping tool and to mitigate government penalties, all export records should be stored separately at an external location.

How do I process my shipment using CERS?

The instructions will vary depending on the shipping solution you are using to create your FedEx Express shipment.

When using FedEx Ship Manager™ or new FedEx Ship Manager at fedex.ca*, follow the instructions below:

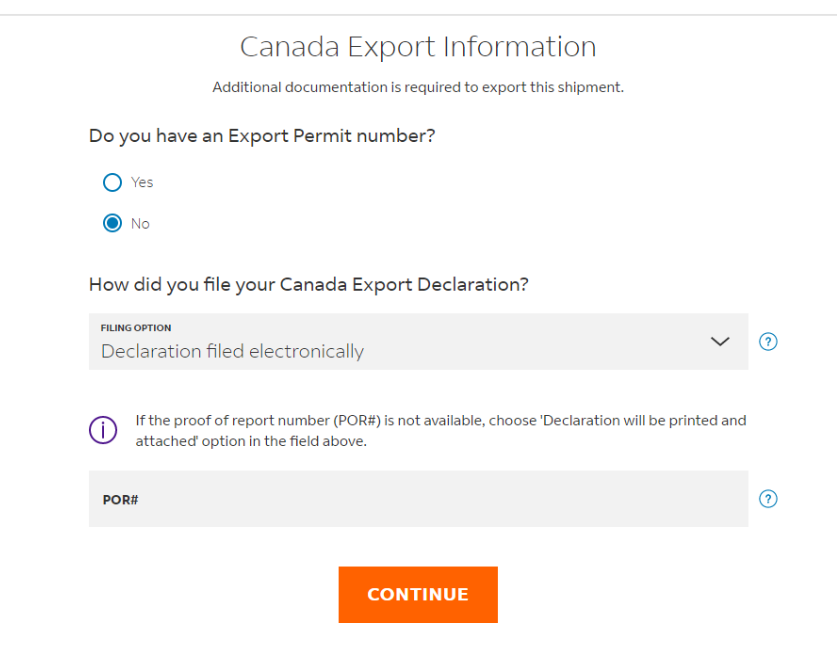

If you have already completed your export declaration and have obtained your Proof of Report number (POR#), go to the ‘Canada Export Information’ section and then scroll down to ‘How did you file your Canada Export Declaration?’, select the “Declaration filed electronically” from the drop-down menu, then enter your POR# in the field provided.

If you have not completed your export declaration, go to the ‘Canada Export Information’ section and then scroll down to ‘How did you file your Canada Export Declaration?’ and select the “Declaration will be printed and attached” from the drop-down menu. You must include a copy of the electronic export declaration along with your other shipment documentation. Customers using Electronic Trade Document (ETD) will also be required to print and attach the export declaration to their package.

Note:

FedEx Ship Manager users: When shipping documents valued at CAD 2000 or greater and destined to a country other than the U.S., Puerto Rico or the U.S. Virgin Islands, a commercial invoice will need to be generated when creating your shipment to prompt the system to display the POR# field in the ‘Canada Export Information’ section.

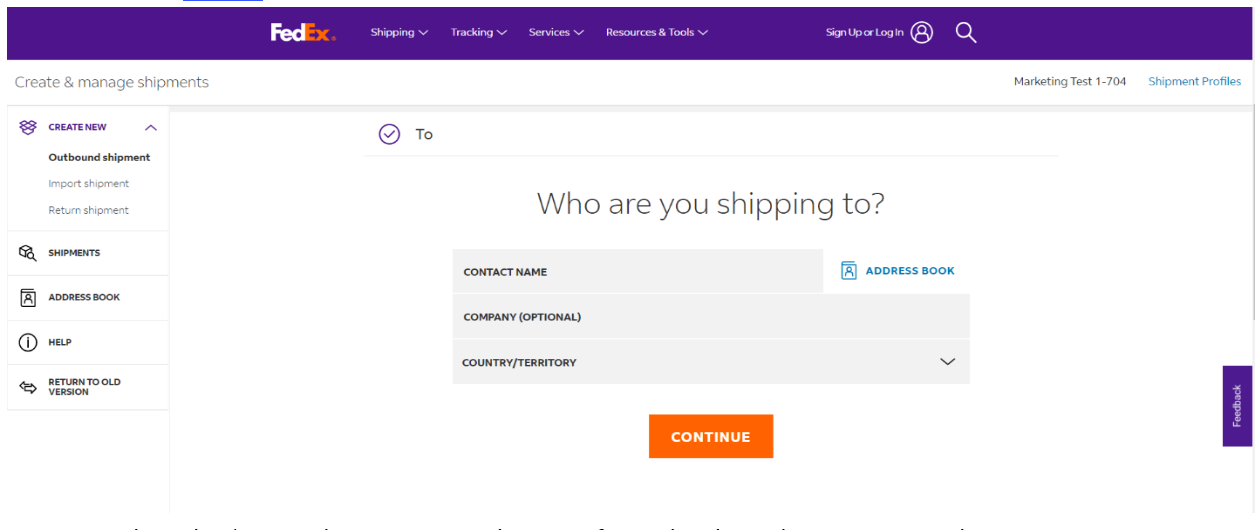

New FedEx Ship Manager users: To ship documents valued at CAD 2000 or greater and destined to a country other than the U.S., Puerto Rico or the U.S. Virgin Islands, you must first select the option “RETURN TO OLD VERSION” from the application homepage to create your shipment

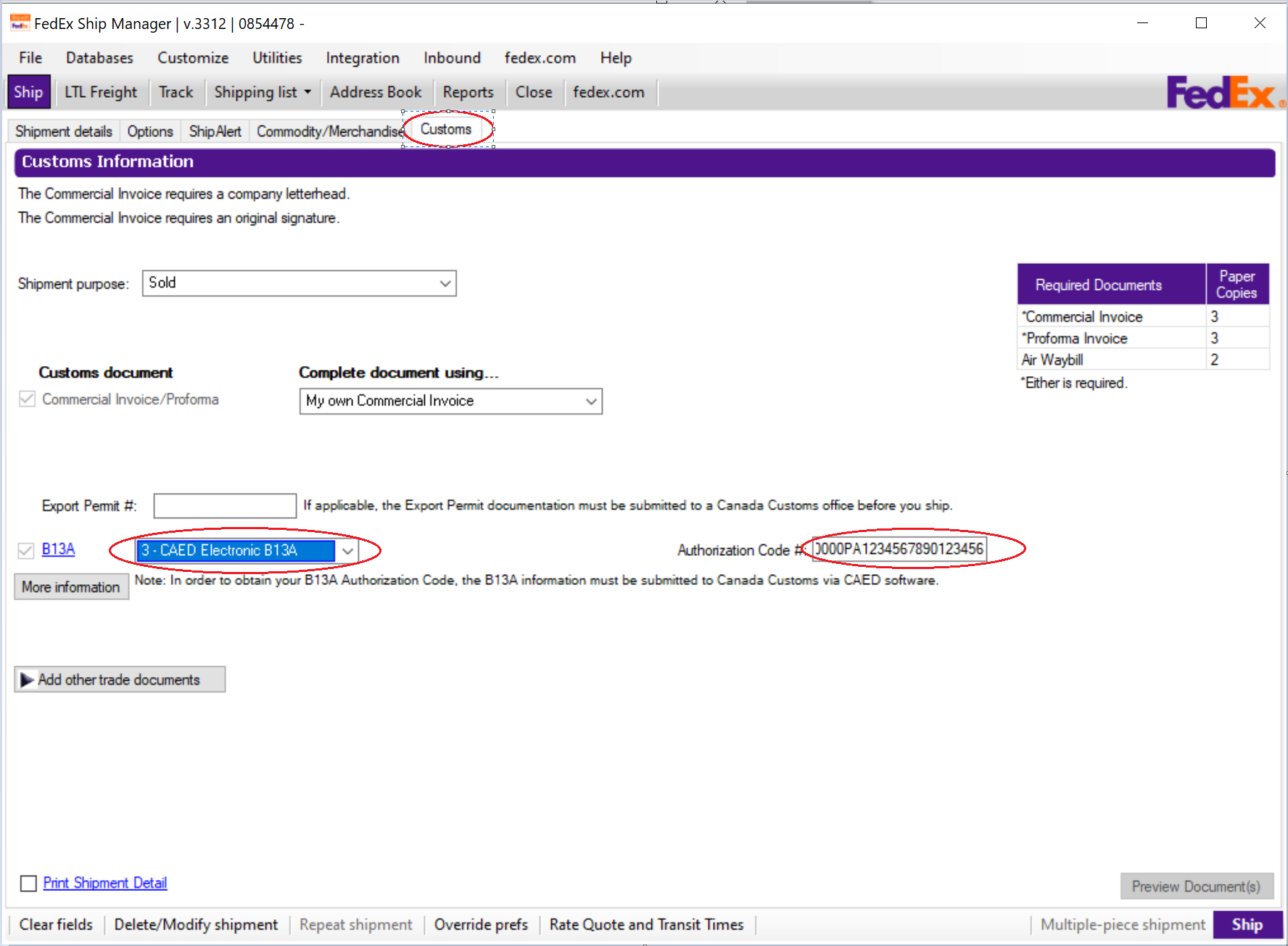

When using the FedEx Ship Manager offline/software solution, follow the instructions below:

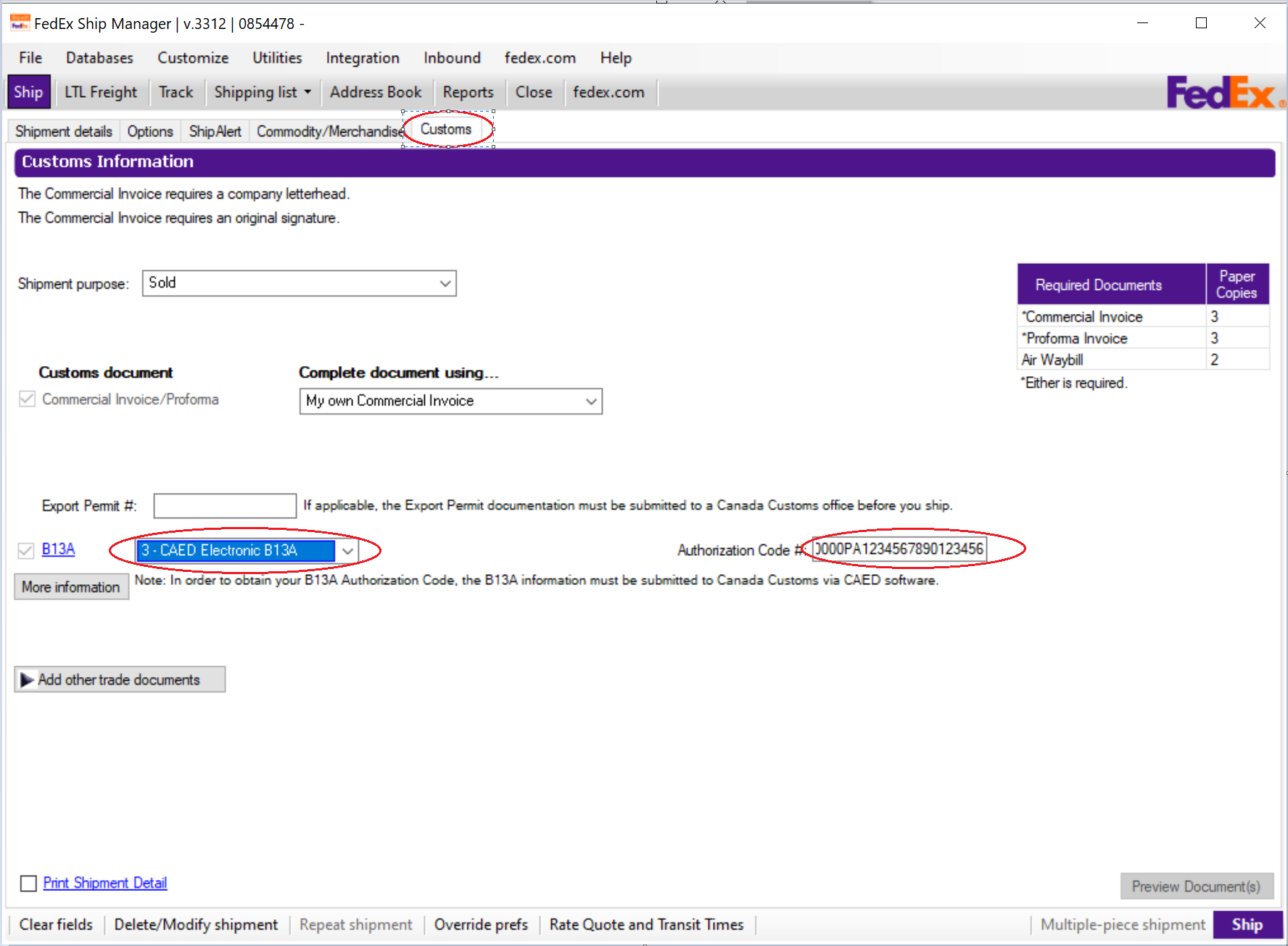

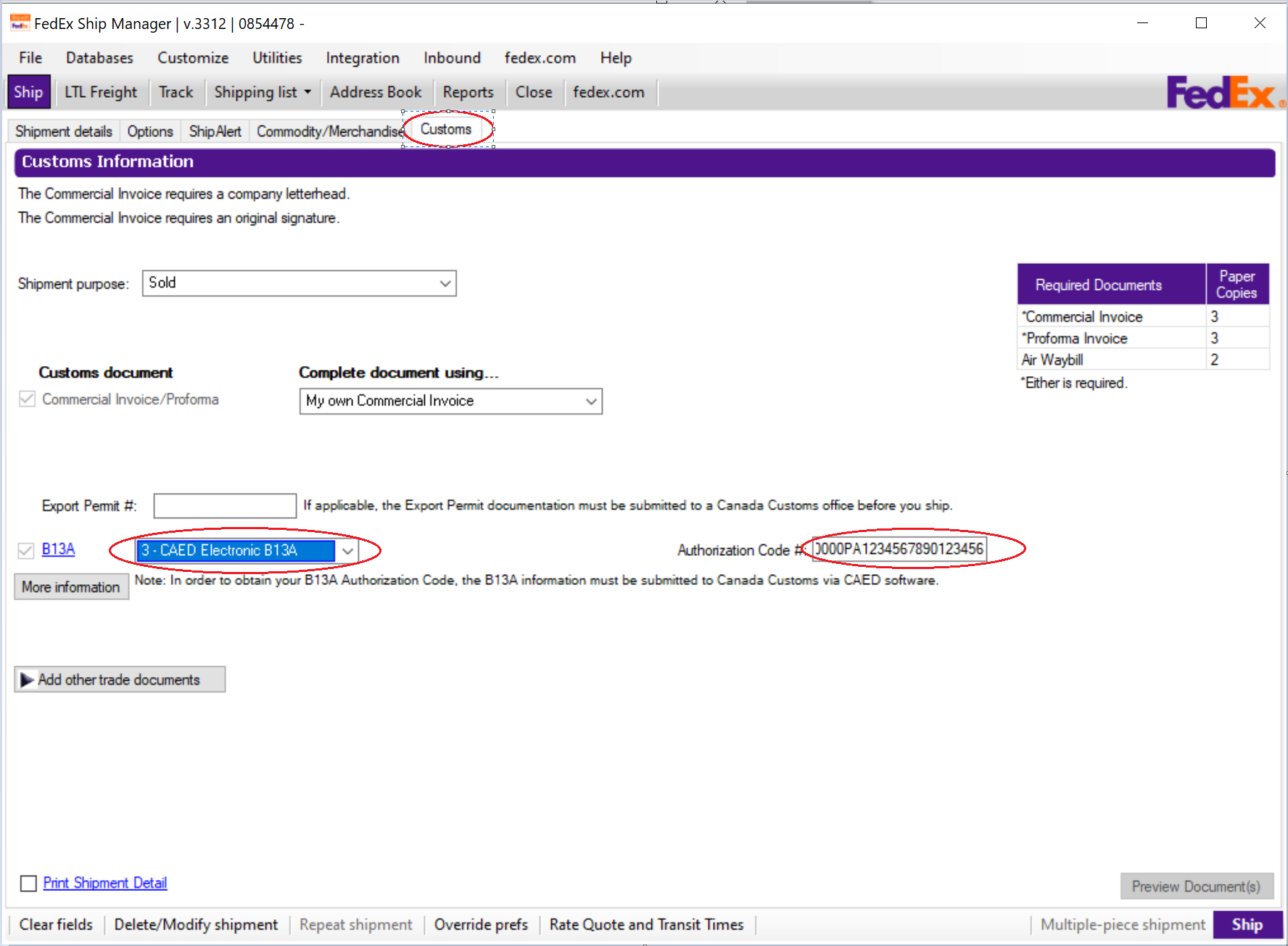

If you have already completed your export declaration and have obtained your Proof of Report number (POR#), click on the ‘Customs’ tab at the top of the page, then scroll down to the B13A section, select the ‘CAED electronic B13A’ option from the drop-down menu and enter your POR# in the ‘Authorization Code #’ field.

Note: The ‘Authorization Code #’ field accepts only 23-digit alpha numeric numbers. If the POR# is less than 23 digits long, please add the necessary number of zeros preceding the POR# to comply with the character requirement for that field (see example in the screen shot below).

I If you have not completed your export declaration, please follow the steps below to obtain your POR# then enter it in the ‘Authorization Code #’ field:

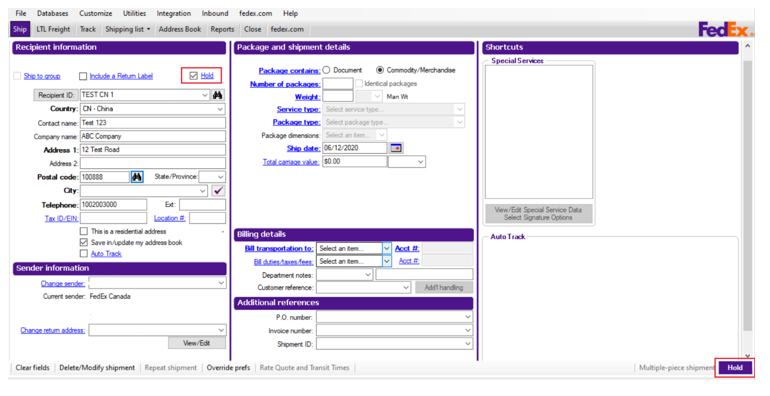

Step 1: Check the ‘Hold’ option and complete all applicable fields (i.e., shipment details, options, commodity information, etc.). Once completed, click the “Hold” button at the bottom of the screen. This will save your shipment in the ‘Hold File List’.

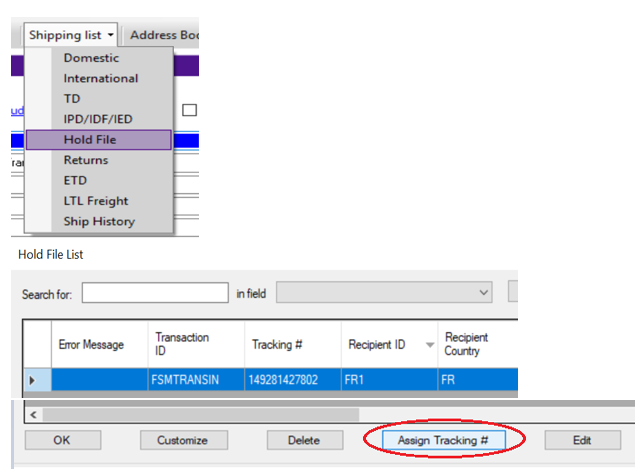

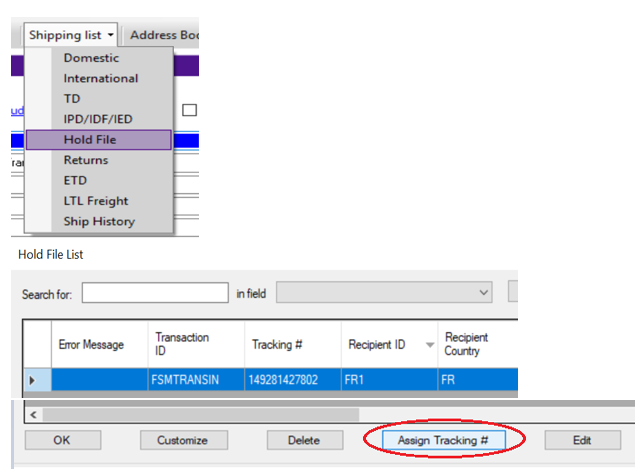

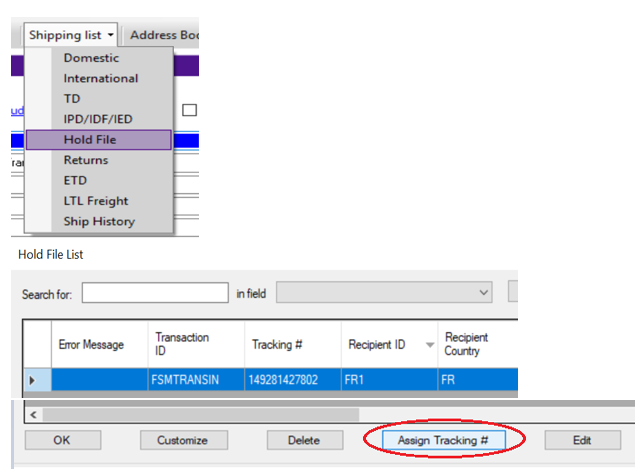

Step 2: Click the ‘Shipping List’ Tab to open a drop-down menu. Select “Hold File” to find your shipment in the ‘Hold File List’. Select your shipment and click the “Assign Tracking #” button to obtain the FedEx tracking number for your shipping label.

Step 3: Retain your FedEx Express International Air Waybill number and log in to CERS to create an export declaration and to obtain your Proof of Report number (POR#).

Step 4: Return to FedEx Ship Manager and complete the FedEx shipping label with the POR# referenced.

Go to the ‘Hold File List’ (refer to Step 2) and select your shipment for completion.

Important: If your goods require any permits, certificates or licenses, please print a copy of your CERS declaration and attach to the shipment with the other shipment documentation (e.g., commercial invoice).

In the event of both scheduled and non-scheduled system outages, exporters must follow the CBSA System Outage Contingency Plan by completing a BSF844-Exporter Contingency Form and presenting two copies of the form to the CBSA office closest to the place of exit (e.g., border crossing or airport) of the goods. Please note that exporters who complete the form and present it to the CBSA are still required to submit an electronic export declaration, once the system outage has been resolved.

After presenting the BSF844-Exporter Contingency Form to the CBSA and receiving approval, exporters must advise FedEx Express by entering the generic code “ECD” the FedEx Express International Air Waybill, FedEx Express Expanded Service International Air Waybill, or shipping label for the shipment. See below for instructions.

When using FedEx Ship Manager™ or the new FedEx Ship Manager at fedex.ca:

Go to the ‘Canada Export Information’ section and then scroll down to ‘How did you file your Canada Export Declaration?’. Select ‘Declaration filed electronically’ from the drop-down menu, then enter ‘ECD’ followed by the year, month, day, and time (24-hour clock) you are creating your shipment in the field provided (e.g., ECD202209241630 – no dashes or spaces).

When using the FedEx Ship Manager offline/software solution:

Click on the ‘Customs’ tab at the top of the page, then scroll down to the B13A section. Select the ‘CAED electronic B13A’ option from the drop-down menu, then enter two leading zeros ‘00’, followed by “ECD”, and ending with the year, month, day, and time (24-hour clock) you are creating your shipment in the field provided (e.g., 00ECD202209241630 – no dashes or spaces).

When using a manual FedEx Express International Air Waybill:

In the ‘Canada Export Declaration’ section of the FedEx Express International Air Waybill and FedEx Express Expanded Service International Air Waybill, you must check ‘B13A filed electronically’ and enter ‘ECD’ in the field provided.

Additional Information

Memorandum D20-1-1: Exporter reporting

Updated CERS CBSA client support and contact information

CERS Portal Electronic Commerce Client Requirements Document (ECCRD)

*Currently, only select customers can access the new FedEx Ship Manager at fedex.ca.